NJ Working Parents, Guardians, and Family Caregivers: Frequently Asked Questions During COVID-19

Many parents, guardians and family caregivers have questions about how to manage work and care responsibilities during the COVID-19 pandemic.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information.

Click here for information on other work benefits and protections and here for additional COVID-19 FAQs.

Updated 9/3/2021.

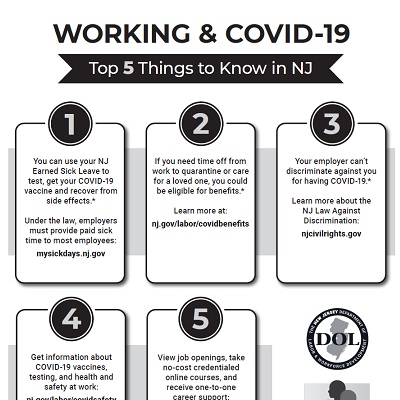

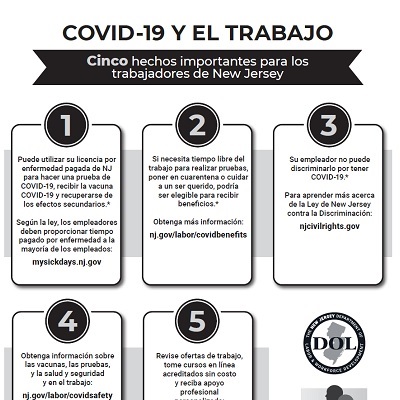

Yes. Most NJ employees have the right to up to 40 hours of earned sick leave each year, paid by their employer, to care for themselves and their children. You can use your sick time if you need to care for your child during remote learning.

Learn more at mysickdays.nj.gov.

Yes. Most NJ employees have the right to up to 40 hours of earned sick leave each year, paid by your employer, to care for themselves and their children, including to get the COVID-19 vaccine. NJ Earned Sick Leave can be used to travel to and from a child’s appointment and to care for them during recovery from side effects.

Your employer must pay you when you use any NJ Earned Sick Leave to which you are entitled. They are required to pay you in the same or next pay period, and the pay must come with your regular pay check or another method that can be deposited or cashed easily.

Yes. Most NJ employees have the right to up to 40 hours of earned sick leave each year, paid by their employer, to care for themselves and their children. Employees can use their sick time to attend school conferences and events, as well as meetings about their child’s health or disability.

Download an Earned Sick Leave handout for parents and guardians (English)

Descarga un volante sobre licencia pagada por enfermedad para padres y guardianes (en español)

Yes. Most NJ employees have the right to up to 40 hours of earned sick leave each year, paid by your employer, to care for themselves and loved ones. Learn more at mysickdays.nj.gov.

As of September 4, 2021, no. Pandemic Unemployment Assistance, a federal benefit which was available for mandated remote learning, or for when a school or place of care closed due to COVID-19, expired September 4, 2021. Learn more at myunemployment.nj.gov/pua.

You may be eligible for Family Leave Insurance benefits if your child has an illness, injury, or underlying health condition that prevents them from returning to school in person. You may also be eligible to receive Family Leave benefits if your child who is participating in remote learning has a diagnosed mental health condition, including ADHD, and you are unable to work because they require your care. To receive Family Leave benefits, your child’s healthcare provider must certify your child’s physical or mental health condition and the need for your care. You may be eligible for other benefits and protections in addition to Family Leave Insurance, such as unpaid, job-protected leave under the NJ Family Leave Act.

You may be eligible to receive Family Leave benefits if your child who is participating in remote learning has a diagnosed mental health condition, including ADHD, and you are unable to work because they require your care. To receive Family Leave benefits, your child’s healthcare provider must certify your child’s physical or mental health condition and the need for your care. You may be eligible for other benefits and protections in addition to Family Leave Insurance, such as leave under the NJ Family Leave Act.

If you are at high risk for COVID-19 due to a serious health condition, you could be eligible for Temporary Disability. Learn more at myleavebenefits.nj.gov. You may also be entitled to a reasonable accommodation from your employer to allow you to safely perform your job. Learn more here.

If you cannot work because you must care for a loved one, you may be eligible for Family Leave Insurance benefits. To receive Family Leave benefits, your loved one’s healthcare provider must certify their physical or mental health condition and the need for your care.

In most instances, you cannot voluntarily quit and receive unemployment benefits. Exceptions could occur where an individual quits or refuses work because the work poses a high degree of risk to their health and safety. The first step is to try to resolve the health and safety issues with your employer. Learn more here.

If your child has mandatory remote learning, and you’re eligible for paid leave under the federal paid sick and child care leave tax credits, those would be options.

With a medical certification, you could be eligible for up to 12 weeks of wage replacement benefits from Family Leave Insurance. Learn more at myleavebenefits.nj.gov.

If you are eligible for job-protected leave under the New Jersey Family Leave Act (NJFLA) and you have not used all 12 weeks of leave within the past two years, you can use the remaining weeks to take job-protected leave to care for your child until you can find child care. Please note that federal FMLA leave runs simultaneously with the NJFLA if the reason for leave (in this case, caring for a child within 1 year of the child’s birth) is covered by both the federal FMLA and the NJFLA. This means that if you already took 12 weeks of leave to care for your child, you were concurrently using both federal FMLA and NJFLA. Consequently, even if you would otherwise be eligible for leave under the NJFLA, you have already exhausted NJFLA leave. Learn more about NJFLA here.

Similarly, if you haven't used all 12 weeks of NJ Family Leave Insurance benefits, and it’s within a year of your child’s birth, you may be able to use additional weeks of this benefit to bond with your newborn. However, these benefits do not cover COVID-19 child care closures.

If you need assistance finding child care, visit the NJ Child Care Resource and Referral Agencies page, administered by the NJ Department of Human Services (DHS). You can also apply for the state’s Child Care Subsidy Program if you need assistance paying for child care, also administered by NJDHS.

If you need assistance finding child care, visit the NJ Child Care Resource and Referral Agencies page, administered by the NJ Department of Human Services (DHS). You can also apply for the state’s Child Care Subsidy Program if you need assistance paying for child care, which is also administered by NJDHS.

The Supplemental Nutrition Assistance Program (SNAP) can provide you with monthly food assistance to buy groceries and helps almost 800,000 NJ residents. While your weekly unemployment benefits do count as income for SNAP eligibility, the additional weekly $300 payments, called Federal Pandemic Unemployment Compensation (FPUC), do not count as income. This favorable change to a federal rule regarding food assistance eligibility for individuals receiving unemployment benefits means more families now qualify for SNAP.

- If you applied for SNAP in the past, but were deemed ineligible because of FPUC income, you may now be eligible.

- This new federal rule can only be applied to SNAP applications completed on and after December 28, 2020.

- The fastest way to apply to SNAP is to submit a new application online or over the phone by calling your local board of social services.

If eligible, SNAP benefits are sent directly to an easy-to-use “Families First” electronic benefits card.

To learn more about SNAP visit www.njsnap.gov. To screen for eligibility, visit www.njhelps.org.

IMPORTANT: When using the SNAP screening tool, in question 8, your regular weekly unemployment benefit counts as income. Do not include the $300 weekly FPUC benefits as a part of your income.

See myunemployment.nj.gov/morehelp for links to assistance with food, housing, child care, health, and more.

Official Site of The State of New Jersey

Official Site of The State of New Jersey