The default savings rate for a RetireReady NJ account is 3% of your gross pay, and that amount is deducted from your paycheck after taxes have been taken out.

You can change your savings rate at any time to as little as 1% or up to a maximum of 100%, within IRS limits. Contributions are made post-tax, and your employer can deduct contributions only from the amount available in your paycheck after other payroll deductions required by law have been made.

Your RetireReady NJ account is a Roth IRA, so the total amount you save must be within the federal government's Roth IRA contribution limits. In 2026, the IRA contribution limits are $7,500 per year (and $8,600 per year if you are age 50 or older), as long as you earn at least $7,500 in wages.

The amount of money you can contribute to a Roth IRA depends on how much you earn and your Modified Adjusted Gross Income (MAGI), which is essentially what you earn at your job, plus any other income from investments and other sources. Your contribution limit also depends on how you file your taxes.

| Tax Year 2026 | |||

| Maximum Contribution Limit | |||

| Filing Status | MAGI* | Age 49 or younger | Age 50 or older |

| Single filer | Less than $168,000 | $7,500 | $8,600 |

| Married filing jointly | Less than $252,000 | $7,500 | $8,600 |

*Modified Adjusted Gross Income (MAGI)

See IRS publication 590-A (2022) Contributions to Individual Retirement Arrangements (IRAs) for more information and an easy-to-follow worksheet for computing your MAGI.

We have a number of tools and resources to help you plan, as well as our retirement savings calculator. You can also talk to a financial or tax advisor to help you assess your options.

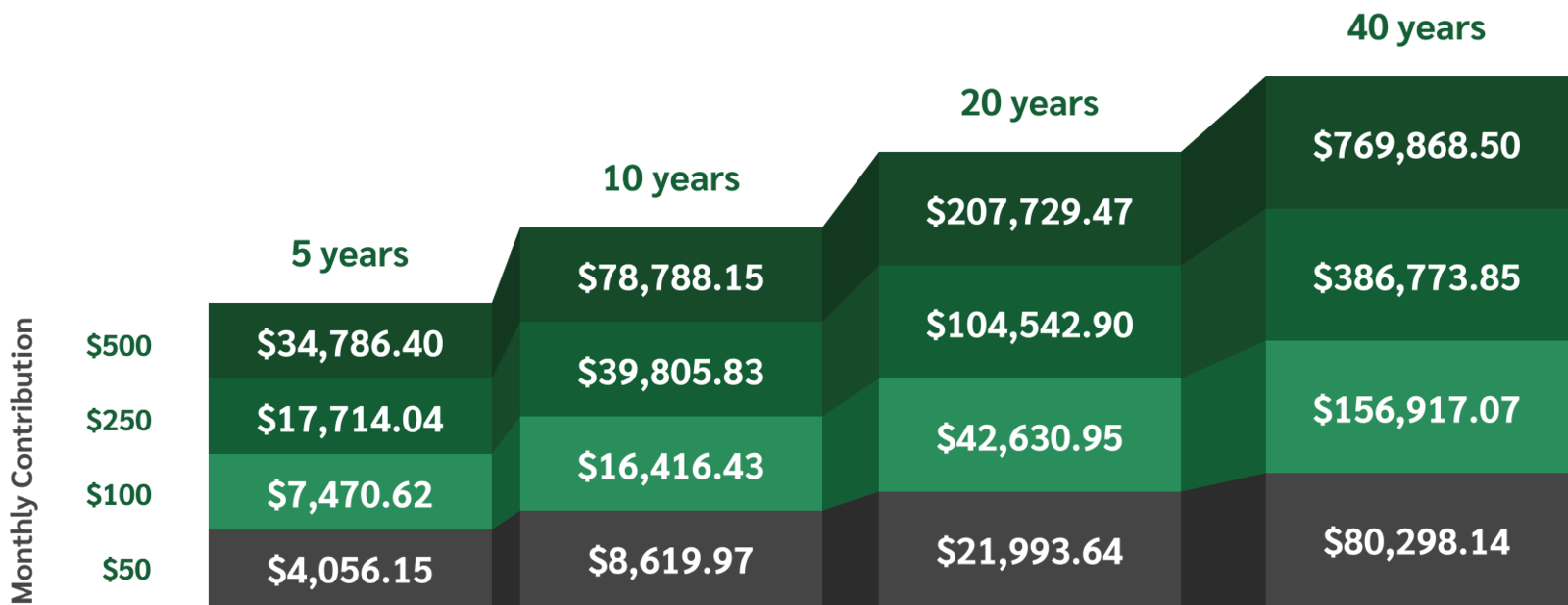

*This hypothetical example shows the potential of what an initial investment of $500 and a monthly contribution at a 5% projected annual rate of return could become over a period of time. Note this is just an example; your actual results may be more or less.