Review of Implementation of Recommendations Regarding Workers’ Compensation Claim Management

- Posted on - 07/11/2023

Table of Contents

- Introduction

- Background, Scope, and, Objective

- Status of 2020 Audit Recommendations

- Recommendations

- Reporting Requirements

Introduction

In our July 9, 2020 audit report, “A Performance Audit of Workers’ Compensation Claim Management” (2020 Audit),[1] we made seven recommendations to the Department of the Treasury, Division of Risk Management (Division) regarding its processing of workers’ compensation claims between January 1, 2012 and June 30, 2015. As required by statute, we conducted a follow-up review of our 2020 Audit of the Division’s administration of workers’ compensation claims to assess whether the deficiencies identified in that audit have been addressed. We found that the Division did not comply fully with any of the seven recommendations. Of the seven recommendations, the Division partially complied with four and did not implement three at all.

The Division’s failure to implement our recommendations increased the risk of fraud, waste, and abuse. It also made it less likely that the Division would provide injured state employees with the care they need while minimizing costs and returning employees to work as quickly as possible.

In the 2020 Audit, we found inconsistent and informal processes for calculating injured workers’ wages led to incorrect payments in about two-thirds of the sampled payments. The follow-up review showed that the Division partially addressed our recommendations by modifying its claims management software and adjusting how it calculated workers’ compensation payments. However, the Division failed to adopt and implement clear policies and procedures that would ensure wage benefits were calculated accurately. The Division’s Investigation Manual, for instance, provided contradictory instructions; one section directs Division employees to consider the prior 26 weeks of salary, while another section directs employees to use the salary at the time of the accident. Additionally, the Division relied on wage data from human resource offices at other agencies, which was frequently inaccurate, and supervisors did not consistently perform or document their reviews of payment calculations.

The 2020 Audit also found that the Division did not have policies and procedures in place to identify repeat claimants or to address specific hazards causing repeat injuries, potentially leading to further on-the-job injuries and additional claims being paid out. Our follow-up review found that the Division temporarily developed, but then abandoned, an ad hoc procedure to identify claimants with multiple claims. The Division did not establish any formal policies or procedures to perform site visits or recommend safety training. It also disregarded our recommendation that it establish the criteria and protocols for authorizing the use of investigatory techniques for suspected fraud, waste, and abuse, including by repeat claimants, by interviewing witnesses and surveillance.

Our review also found that the Division still failed to adequately monitor the performance of its contracted managed care organization. We found that the Division implemented contract performance metrics that include accountability measures, but the Division did not sufficiently oversee performance and relied on the managed care organization’s self-reporting. As a result, some employees may have been out of work longer than necessary, and the Division may have made unwarranted payments to the vendor.

Although the Division alone cannot prevent all fraud, waste, and abuse in workers’ compensation claims, we found that the Division was unnecessarily passive. Since 2007, the Division has been required by law to prepare and distribute monthly accident reports. It has also been required to convene state agency representatives quarterly to meet as a Risk Management Committee to review those reports and to address issues related to worker safety and capital repairs that may prevent injuries. The Division has not carried out these duties. We found no evidence that the Division ever issued the required reports or that the Risk Management Committee required by state law to meet quarterly since 2007 has ever met.

In FY 2022, the Division processed some 8,000 claims, amounting to $96 million. In view of the substantial funds at stake and the importance of preventing injuries, the Division should fully implement all of our recommendations.

Background, Scope, and, Objective

The Division, which was established by N.J.S.A. 52:18A-219, administers a workers’ compensation insurance program for state government employees, employees of certain higher education institutions, and employees of the New Jersey Sports and Exposition Authority. The program is self-insured, which means the State pays claims directly using taxpayer funds.

In our 2020 Audit, we selected a statistical sample of 30 claimants and judgmentally selected 6 claimants with the highest number of claims submitted during their employment with the State between 1978 and 2016. We identified weaknesses in the Division’s operating practices and internal controls for the management and administration of the State’s workers’ compensation program for state employees. Specifically, the Division improperly processed workers’ compensation benefits totaling $54,605 contrary to the program limitations of applicable statutes and its own policies and procedures. We found that the Division made payments without obtaining relevant wage data, miscalculated compensation payments, failed to recoup duplicative workers’ compensation payments made to a claimant who also received an accidental disability pension, and did not have adequate processes for monitoring when a claimant returned to work. Additionally, the Division did not properly ensure that the managed care organization responsible for managing medical services satisfied all contract requirements.

For our follow-up review, we judgmentally selected a sample of 20 workers’ compensation claims that were filed during fiscal years (FY) 2021 through 2023 that were identified as including temporary workers’ compensation (TWC) payments. This sample is a subset of the total universe of workers’ compensation claims. A summary of claims with costs managed by the Division and the associated total claim costs for FYs 2021 and 2022 appear below.[2] Costs include, but are not limited to, medical payments, compensation payments for lost wages, permanent disability payments, and other claim-related expenses.

The objective of our follow-up review was to determine if the Division has implemented the seven recommendations contained in our 2020 Audit report.

Status of 2020 Audit Recommendations

Recommendation 1

Implement a process to ensure wages specified in the policies and procedures are used in the calculation of workers’ compensation benefits. In addition, ensure consistent calculation of workers’ compensation wage benefits through the use of a formal process and template to request and obtain wage data from a claimant’s human resource office. (2020 Audit, p. 10)

Status: Partially Implemented

Our 2020 Audit found that the Division did not have a formal process for requesting, receiving, and reviewing claimant wage data and did not have a standard template for calculating compensation benefits. The Division processed TWC payments for some claimants without verifying that the payments were accurately calculated using all relevant wage data required by N.J.S.A. 34:15-37 and the Division’s Investigation Manual (Manual). The Audit found that the Division processed benefits for some claimants without taking into account the claimant’s overtime pay as required by the Manual. (2020 Audit, p. 7)

In response to that finding, the Division advised in its October 2020 corrective action plan that it planned to make changes to its Risk Management Information System (RMIS) to enable it to include overtime and other wages when calculating compensation benefits.

Our follow-up review found the Division revised its processes for ensuring appropriate wages are used in the calculation of workers’ compensation benefits. We requested the Division’s policies and procedures from FY 2019 through November 2022. We were provided with the Manual, which includes a template used to request and receive wage data. The Division also produced two memoranda that address the template and process for collecting wage information. In August 2020, a month after the 2020 Audit was released, the Division modified the wage calculation template to include overtime and other payments, including bonuses, earned in the 26 weeks preceding a claimant’s accident. A month later, in September 2020, the Division updated the template to include 26 weeks of actual earned wages rather than the use of an annual salary to calculate wages. We found the terms of the Division’s Manual and templates that were in effect during the scope of our review were in conflict as detailed below.

Upon further inquiry, the Division reported in April 2023 that it relies upon an additional memorandum and template that had not been provided to us. In May 2021, the Division revised the template again and returned to using annual salary at the time of the claimant’s accident rather than 26 weeks of actual earned wages. None of these three memoranda or revised templates was reviewed by legal counsel.

The Manual provided conflicting guidance about what information Division staff should collect and about the method to calculate how much compensation should be paid. One section directs Division employees to consider the prior 26 weeks of salary, while another section directs employees to use the salary at the time of the accident.

We urge the Division to obtain legal guidance to interpret N.J.S.A. 34:15-37 and establish the appropriate methodology for calculating compensation payments. Additionally, we recommend that the Division update its Manual and templates to establish policies and procedures that are consistent with that interpretation. Providing uniform guidance will aid in ensuring compliance with the law and reducing confusion and errors.

Our review also found that the Division frequently received inaccurate wage data from human resource offices within other state agencies. The Division received inaccurate wage data for 7 of the 20 sampled claimants, or 35 percent. State entities submitted wage data for claimants that excluded bonuses and contained errors such as the incorrect number of weeks worked and inaccurate overtime figures that were based on the entire year instead of the previous 26 weeks. These inaccuracies resulted in improper payments of $22,430.

We urge the Division to provide training to human resource offices to reduce wage submission errors. Additionally, to ensure accurate wage data is used in the calculation of TWC payments, we recommend the Division identify sources for data that enable it to obtain wage information directly without relying on agency staff. Such information is available from the Department of Labor.

Recommendation 2

Develop policies and procedures to reduce payment errors through the use of a formal process, such as the supervisory review and approval of a standard template, or an automated function in the claim management system, to calculate compensation benefits in lieu of the manual process currently in place. (2020 Audit, p. 10)

Status: Partially Implemented

Our 2020 Audit found that the Division did not calculate TWC payments in accordance with statutory requirements and Division policies. Claims investigators manually calculated TWC payments using information received from the claimant’s human resource office. Our audit found that 370 of the 554 TWC payments tested were not calculated in accordance with statutory requirements and Division policies. These miscalculations resulted in improper payments. (2020 Audit, p. 6)

In response to this finding, the Division advised in its corrective action plan that it sent a letter to all state agencies with a standard template that the agencies were required to follow. In addition, the Division sent an email to all Division supervisors and claims investigators reminding them to follow the proper procedure.

We confirmed that the Division created an internal calculator within the RMIS system to calculate TWC payments and that supervisors began reviewing and approving calculations. The internal calculator function calculates a claimant’s TWC payments based on wage data entered by the Division, which includes the claimant’s salary and other earnings (e.g., overtime, bonuses, shift differential, etc.). We found, however, that the Division did not implement formal policies and procedures and that the new processes were not consistently followed by Division staff.

Our sample review of TWC payments did not identify any calculation errors, but found that supervisors did not consistently perform or document their reviews of payment calculations. During our review, the Division drafted and distributed an internal memorandum requiring the use of the internal calculator and supervisory approval of the payment calculations. Through a second subsequent review, we determined that Division staff used the calculator for all claimants, but there was no evidence of supervisory approval for three of the ten claims reviewed. The Division advised it is in the process of updating its Manual to include provisions requiring the use of the calculator and supervisory approval. We urge the Division to finalize formal policies and procedures to reduce payment errors through mandatory supervisory review of TWC calculations and to require the use of the internal calculator in the Division’s claim management system.

Recommendation 3

Implement policies and procedures that effectively manage multiple claims to prevent potential abuse of the workers’ compensation program and to improve safety and accident prevention. In addition, assess the current automated system and determine if information technology detective controls can be designed to identify multiple claims by a single claimant or for a single location. (2020 Audit, p. 11)

Status: Not Implemented

Our 2020 Audit found the Division failed to identify claimants with multiple claims. This was significant, as noted in that report, because workers’ compensation programs are in part intended to promote safety and prevent accidents. We wrote that “[e]ffective workers’ compensation programs identify opportunities to prevent a claim and to eliminate, or minimize the severity of, future injuries. Minimizing the severity of an injury may reduce recovery time for an injured employee and lower the cost of a claim to an employer.” (2020 Audit, p. 8)

The 2020 Audit noted the following facts:

- We reviewed case files of six claimants with open claims who had submitted the largest number of claims during their state employment. These six claimants collectively filed 266 claims between 1978 and 2016.

- We selected 101 of the 266 claim incident reports and accompanying case files and found that 23 of the 101 claim incident reports, or 23 percent, lacked evidence of the claimant’s supervisor’s agreement with the details of the claim. There was no evidence that the claims investigators made further inquiries to the claimant’s supervisor.

- One facility had 23 claims submitted between 2007 and 2019 related to faulty gate and door lever mechanisms. These claims were filed by 19 employees. For that period, the Division had already paid over $1.5 million in workers’ compensation benefits directly related to this facility’s gate and door levers. That amount that did not include pending claims for injuries that occurred during that period. The estimated cost to replace the gate and door levers at the facility was $4 million.

The 2020 Audit found that the Division did not have policies and procedures that address claimants who file multiple claims. The Audit found that without specific guidance regarding what to do, claims investigators have too much discretion in deciding if and when to initiate investigations. We concluded that “[w]ithout such procedures to conduct follow-up investigations of multiple claims, the Division potentially delays remedying underlying safety issues and fails to prevent additional injuries. The lack of follow-up investigations weakens effective claim management and hinders detection of abuse of the workers’ compensation program.” And: “The Division should improve oversight and monitoring of claims that focus on safety and accident prevention. Doing so would likely reduce the number of repeat injuries and thereby lower the cost of the workers’ compensation program.” (2020 Audit, p. 10)

In response to these findings, the Division advised in its corrective action plan that it had started identifying claimants with multiple claims and had begun notifying the claimant’s employer to take necessary action including, but not limited to, sending the employee for a fit-for-duty assessment. The Division noted that multiple claims do not necessarily point to potential abuse. Rather, they could be the result of the individual’s physical condition, lack of training, unaddressed safety issues, or their occupation. The Division stated that state occupational safety resources and support are needed to fully implement this recommendation. Additionally, the Division contended in its response to the 2020 Audit that it does not have the authority to mandate a department or agency to make any repairs or changes necessary to improve workplace safety.

Our review found there is still no formal policy to manage claimants or locations with multiple or excessive claims. In July 2020, the Division began to recommend on an ad hoc basis that agencies require that claimants with multiple or excessive claims undergo fit-for-duty assessments. Fit-for-duty assessments seek to determine whether an employee is able to perform the duties required for the employee’s job. These assessments may reduce the risk of future injuries and improve workplace safety. We note that the ad hoc procedures instituted by the Division did not identify thresholds for fit-for-duty assessments.

Under the ad hoc procedures, the Division recommended between July 2020 and December 2022 that agencies carry out fit-for-duty assessments for 20 claimants. These claimants collectively filed 267 claims during the course of their careers with the state. Our follow-up review sampled 20 claimants who filed up to 40 claims throughout their careers. We further examined a subset of the sample for five claimants with the most claims filed during their employment history. These five claimants filed 181 claims throughout their careers and averaged a total disability of approximately 42 percent. Two of the five had similar claim and injury histories as the 20 claimants the Division recommended for fit-for-duty assessments. These two claimants averaged 37 claims filed throughout their careers and had total disability percentages of approximately 63 percent but were not recommended for fit-for-duty assessments. This demonstrates that the ad hoc procedures did not uniformly identify similarly situated claimants, thereby not adequately addressing the recommendation related to preventing abuse of the workers’ compensation program and improving workplace safety.

During our review, we learned that the Division stopped recommending fit-for-duty assessments in April 2023. Stakeholders expressed concerns about communication regarding the need for the assessments and the absence of formal procedures for the assessments. They also expressed concerns that the fit-for-duty assessments, given the ad hoc nature of the policy implemented by the Division, may be viewed as retaliatory or discriminatory. These concerns should be addressed to the extent possible through effective communication, formal guidance from the Division, and the adoption of appropriate regulations, but should not undermine the State’s ability to guard against waste and abuse of the workers’ compensation program. State employees should not be able to file multiple workers’ compensation claims without triggering greater scrutiny regarding the validity of the claims and the potential for waste and abuse.

The Division correctly points out that its role is limited because it alone cannot prevent waste and abuse in the State’s workers’ compensation program. But under existing law, it can do – and since 2007 has been required to do – considerably more than it has to date. The Division’s claim that it does not have the authority to address our recommendation fails to take into account that it was directed by the Legislature in 2007 to coordinate an effort that would comprehensively address risk within state government. Through the enactment of N.J.S.A. 52:18A-222, the Legislature established the Risk Management Committee (Committee). The Committee includes the commissioner of each principal department in State Government or their designee. Additionally, the 2007 law designated the State Treasurer and the Commissioner of the Department of Banking and Insurance as co-chairpersons of the Committee. The director of the Division is designated the Executive Secretary of the Committee. Quarterly meetings are required, during which the Committee is directed by law to review accident frequency reports prepared by the Division; review policy issues related to worker safety and capital repair issues and their relationship to workers’ compensation claims; develop a program and schedule for risk management trainings of appropriate managers within the principal departments; and oversee the establishment and operation of the risk management committees of each of the principal departments.

The same 2007 law required the Division to “[c]ompile and distribute, on a monthly basis, accident frequency reports to the Governor, the commissioner of each principal department of State Government, and the Legislature. These reports shall track each department’s current accident rate compared to historical trends and shall include summaries of any protocols in place to reduce risk.”[3]

We found that the Committee did not meet during the scope of our follow-up review. There is no indication that the Committee has ever met since its creation in 2007, as demonstrated by the fact that the Division could not provide evidence of any Committee meetings ever taking place. We found accident frequency reports have never been, and were not currently being, prepared and distributed to commissioners, the Governor, and the Legislature.

The failure of the Division to implement the 2007 law at any point, especially after the recommendations we made in our 2020 Audit, undermines an important element of New Jersey’s approach to risk management and employee safety. It also increases the likelihood of fraud, waste, and abuse in the workers’ compensation program.

We again recommend that the Division implement policies and procedures that effectively manage multiple claims to prevent potential abuse of the workers’ compensation program and to improve safety and accident prevention. To that end, we urge the Division to assess whether information technology can be leveraged to identify multiple claims by a single claimant or for a single location.

Lastly, we urge the Division, in consultation with the State Treasurer and Commissioner of the Department of Banking and Insurance, to conduct quarterly Committee meetings, to address its operational, safety, and claims management concerns with the Committee, and to compile and distribute accident frequency reports as required by statute.

Recommendation 4

Develop policies and procedures to identify claimants with overlapping benefits as a result of employment or work status changes. These procedures should include appropriate coordination with other state agencies to identify and prevent overlapping benefits and to recover and recoup improper payments. (2020 Audit, p. 11)

Status: Partially Implemented

Our 2020 Audit found the Division did not communicate with the Division of Pensions and Benefits (Pensions and Benefits) in the Department of the Treasury regarding changes in a claimant’s work status when a claimant began receiving a pension. The Manual specifies that a claimant must reimburse the state for workers’ compensation benefits received after the claimant begins receiving an accidental disability pension. In addition, the Audit found that the Division did not have an adequate process for monitoring when a claimant returned to work. This weakness resulted in TWC payments of $12,284 over a four-month period in FY 2015 to a claimant who had returned to work, contrary to N.J.S.A. 34:15-12 and the Manual. (2020 Audit, pp. 7-8)

In response to this finding, the Division advised in its corrective action plan that the assigned Pensions and Benefits employee sends a form letter to the Division requesting information regarding TWC and/or permanency awards[4] before a pension check would be issued to a claimant. In addition, the Division advised human resource offices to notify the assigned claims investigator and the claimant’s supervisor when any employee receiving TWC or permanency award benefits filed for an ordinary or accidental disability pension as a result of a work-related injury.

We reviewed documentation for five claimants that were identified as receiving accidental disability pension benefits during the scope of our follow-up review. Our testing found Pensions and Benefits communicated and exchanged information for all applicable claimants. One claimant’s memorandum did not contain all relevant TWC payments. This error resulted in the Division underreporting $4,100 in overlapping benefit payments which appear to have been duplicative, thus requiring repayment or offset by Pensions and Benefits. The overpayment was associated with an overlap in benefits for a claim filed in 2019, whereas Pensions and Benefits’ form letter to the Division only included a 2018 claim when requesting information. When questioned, the Division indicated that it is not required to provide information about claims not specifically referenced by Pensions and Benefits in its form letter. We take issue with the Division’s position as the Division, rather than Pensions and Benefits, is the agency with complete records of all TWC payments for any given period. As a best practice, and in order to protect state resources, in response to the form letter, the Division should provide all relevant information to Pensions and Benefits to ensure duplicative payments are recovered in accordance with statutory requirements.

In addition, we expanded our follow-up review to evaluate the Division’s administration of TWC for individuals approved for ordinary disability pensions (ODP). Our review found the Division’s policies and procedures regarding overlapping TWC payments and ODP benefits were not compliant with N.J.S.A. 34:15-12. This statute allows claimants to receive TWC payments to replace lost earnings. When a claimant is approved for an ODP and retroactively receives ODP benefit payments, there are no longer any lost earnings to be replaced. However, the Division’s policies and procedures allowed TWC payments to be made at an offset rate until a claimant “returned to light duty work, reached maximum medical improvement or has reached a plateau in care.” During our review, we noted that the Division stopped TWC payments as soon as it learned of a claimant's ODP approval. Furthermore, the Division’s understanding was that 100 percent of the TWC paid during the retroactive period should be recouped and that offsets should not be applied to TWC payments. The Division also operated under the belief that, going forward, the Attorney General’s Office would handle the process of calculating and recouping the TWC overpayments.

We also identified an ongoing communication problem involving when a claimant has been approved for an ODP. Three of the five claimants we examined that received ODPs did not show evidence of communication regarding the approval of the ODP. These claimants collectively continued to receive approximately $104,500 in TWC payments after the approval dates of their respective ODPs without any indication that these monies would be required to be repaid. After this matter was brought to the Division's attention, the Division documented the claimants’ files and communicated the need for recoupment to the Attorney General’s Office.

Finally, the Division did not update its policies and procedures for identifying individuals who return to work and still receive TWC payments. Despite the fact that our testing did not identify any new instances in which a claimant returned to work and continued to receive overlapping TWC benefits, we once again recommend that the Division develop formal policies and procedures to establish when individuals return to work. Additionally, we reiterate our strong recommendation that the Division formally establish methods to identify individuals receiving overlapping benefits.

Recommendation 5

Implement policies and procedures that require more frequent case file reviews and timely monitoring of claimants’ work status changes. (2020 Audit, p. 11)

Status: Not Implemented

Our 2020 Audit found that the Division inadequately documented its case file reviews. We judgmentally sampled 10 of the 41 claims submitted by the 30 claimants in our statistical sample. The case files for these ten claims did not include all required documentation, evidence of case monitoring, or evidence of case file reviews. We also noted significant lapses in time – on average 44 days – between the entries of case file notes that reflected any review, update, or change in claim status for claimants who received compensation payments. We found that the failure of Division investigators to consistently conduct and document timely reviews, including, at a minimum, the update of claim status and verification of a claimant’s return-to-work status, resulted in improper benefit payments. (2020 Audit, p. 8)

In response to this finding, the Division advised in its corrective action plan that it would develop and implement a policy to identify and conduct timely reviews of claimants receiving TWC. In addition, the Division advised that it would schedule quarterly reviews of all claimants who are out of work on TWC for longer than nine months.

Our review found the Division has not implemented formal policies and procedures requiring more frequent case file reviews and monitoring of claimants’ work status. However, our review of ten sampled claims found a significant increase in the frequency of file reviews and case documentation. Specifically, we determined that the average number of days between diary notes while a claimant was receiving TWC payments was 16 days, down from 44 days in our 2020 Audit. Additionally, we tested nine claimants that received more than nine months, or 270 days, of consecutive TWC payments. On average, these claimants received TWC payments for 602 days during the scope of the follow-up review. Despite the Division’s commitment in its corrective action plan, there was no evidence that Division staff conducted quarterly reviews for these claimants.

We again urge the Division to implement policies and procedures that require more frequent case file reviews and timely monitoring of claimants’ work status changes.

Recommendation 6

Revise policies and procedures to improve claim management operations to prevent abuse and improve safety. These procedures should establish the criteria and protocols for authorizing the use of investigatory techniques, including, for example, the timing and frequency of site visits, witness interviews, and surveillance. (2020 Audit, p. 11)

Status: Not Implemented

Our 2020 Audit found that the Division did not have specific procedures in place to identify, monitor, and address repeat injuries that may be prevented through corrective action or health and safety training. Our review of 101 claim incident reports and accompanying case files found 23 did not include evidence that the claimant’s supervisor agreed with the facts asserted in the claim. There was no evidence that the claims investigators made further inquiries to the claimant’s supervisor. In addition, there was no evidence that the Division conducted any follow-up, such as surveillance, safety officer interviews, or site visits to verify the accuracy of the claim. Nor was there any evidence that the Division evaluated whether the conditions that caused the accident could be mitigated. (2020 Audit, p. 9)

In response to this finding, the Division advised in its corrective action plan that surveillance would be ordered if, after consultation with the Attorney General’s Office, it is determined that there is strong evidence of fraud and that surveillance would support that finding. In addition, the Division stated that it had started to identify claimants with multiple claims and notifying the claimant’s employer to take necessary action including, but not limited to, sending the employee for a fit-for-duty assessment as noted in Recommendation 3.

Our review found the Division has not revised its policies to improve claims management operations to prevent potential abuse and improve safety. As discussed in Recommendation 3, we noted the Division temporarily developed an ad hoc procedure to identify claimants with multiple claims and notify their human resource offices. The Division, however, has not established formal policies or procedures to perform site visits or recommend safety training.

We performed testing for 10 claimants who were identified as having the highest number of claims filed in our sample of 20 claimants. These ten claimants collectively filed 300 claims during the course of their state employment. Testing did not identify any evidence that surveillance, site visits, or safety training recommendations were made for claims filed during the scope of our review for these claimants.

We once again urge the Division to revise policies and procedures to improve claim management to prevent abuse and improve safety. These procedures should establish the criteria and protocols for authorizing the use of investigatory techniques, including, for example, the timing and frequency of site visits, witness interviews, and surveillance.

Recommendation 7

Develop policies and procedures to include appropriate monitoring of the vendor’s reporting requirements to ensure that all provider reports are submitted to the vendor as required and that these reports include all relevant and required claimant data including the return-to-work date. (2020 Audit, p. 13)

Status: Partially Implemented

Our 2020 Audit noted that the Division delegates through contract the management of medical services to a managed care organization (vendor). The Audit found the Division failed to implement controls to provide adequate oversight and monitoring of its contracted vendor to ensure all performance requirements of the contract were met. We judgmentally selected 10 of the 41 sampled claims to verify that service providers submitted medical reports to the vendor in accordance with the terms of the vendor’s Preferred Provider Manual.[5] The Division received 411 medical reports for these ten claims. Our testing found that the Division received 186 of the 411 medical reports later than one business day after the medical treatment was provided, contrary to the requirements of the vendor’s Provider Manual. On average, the Division received these reports 32 days after the medical treatment date. In addition, we found that in 359 of the 411 medical reports reviewed, or 87 percent, the service providers did not include the estimated return-to-work date. The vendor’s failure to ensure that the providers satisfied the reporting requirements may result in longer claim periods, a delayed return to work, and an increased workers’ compensation expense that could be reduced with appropriate monitoring. (2020 Audit, p. 12)

In response to this finding, the Division advised in its corrective action plan that it conducts quarterly performance reviews of its vendor in accordance with its current contract. In addition, the current contract provides that the Division may retain ten percent of the vendor’s monthly billings until the quarterly review is completed and the Division deems the vendor’s performance satisfactory.

We found that the Division has made some progress, but there is more to be done.

Medical Reports

Our initial audit found that medical providers regularly failed to timely submit documentation to the vendor contracted by the Division. Specifically, the Audit found that medical providers on average submitted documents to the vendor 32 days after the date of the doctor’s appointment. As part of our follow-up review, we performed testing to determine if there were still delays in the submission of documentation by medical providers to the vendor. Our testing of a selected sample of ten claimants found that providers on average submitted 53 of the 138 physician reports reviewed 18 days after the office visit with the claimant. The vendor’s Patient Care Policies require providers to submit a dictated note/report of the injured worker’s office visit to the vendor within three days of the office visit. Delays in the submission of pertinent medical documentation may lead to longer claim periods, a delayed return to work, and an increase in workers’ compensation expenses. We note that this is a vendor policy and not a performance metric in the contract.

Performance Metric Assessments

The vendor contract, effective since 2018, contains 27 performance metric requirements. The contract also contains provisions that allow the Division to retain ten percent of monthly billings, subject to release pending a “certification by the State Contract Manager that all services have been satisfactorily performed.” If the Division determines that the results of the vendor’s quarterly performance review are satisfactory, the withheld monies may be released to the vendor; if not, the funds are retained by the State. Initially, the vendor only reported to the Division regarding a single metric – the requirement to schedule new appointments, diagnostic testing, and physical therapy within three business days after receipt of a recommendation from a medical provider. In November 2019, the vendor expanded its reporting to include a quarterly assessment of all 27 metrics.

The vendor billed the Division $6.5 million between July 2020 and October 2022. For that period, we found that the vendor failed two quarterly performance reviews, resulting in the State withholding approximately $141,000 of that payment to the vendor. When we expanded our review to February 2018 through October 2022, we found that the vendor billed a total of $13.7 million and that the Division’s State Contract Manager withheld funds in the amount of $767,240 due to ten failed quarterly performance reviews. For all of the quarterly performance reviews, the vendor self-reported the results to the Division, and we found that the Division did not require sufficient documentation to support those results.

Performance Metric Assessment Methodology and Support Documentation

We requested supporting documentation from the vendor for the second and third quarter 2022 performance reviews. We also requested that the vendor provide a methodology of the assessment for each performance metric. Our examination found that the methodology and documentation supporting 2 of the 27 performance metrics was not sufficient.

The first metric requires the vendor to schedule new appointments, diagnostic testing, and physical therapy within three business days after receipt of a recommendation from a medical provider. The vendor considers any document that contains a recommendation from a medical provider as requiring an action and is considered relevant to the performance metric. We confirmed that since 2019 the vendor only reviews a sample of 25 percent of all documents received from providers to assess their performance. The contract does not expressly permit the use of a sample to determine satisfaction of the performance metric; authorization of such a sample report would be allowed only at the discretion of the Division’s State Contract Manager.

We found that the Division’s State Contract Manager in August and November 2021 questioned whether the vendor’s sampling methodology provided an accurate representation of its performance. In both instances, the vendor reported that it had satisfied the performance metric requirements based on the 25 percent sample, and the Division’s State Contract Manager disagreed. In both cases, the Division identified multiple instances of claim delays and retained ten percent of the billings. Further, the Division’s State Contract Manager at the time communicated to the vendor that the delays resulted in additional costs to the state in responding to legal motions filed by claimants, as well as damaged the Division’s standing before the court. In response, the vendor performed a review of 100 percent of the documents received for an unrelated two-month period and compared the results to their 25 percent sampling methodology. The results did not identify a significant variance between the 25 percent sample and the 100 percent review. The vendor presented these results to the Division in February 2022. The Division’s State Contract Manager ultimately agreed verbally to accept reporting for this performance metric using the sampling methodology despite significant concerns that were previously expressed and having withheld billings for two periods where the vendor indicated that it was in compliance with the performance metric. We find that the Division’s acceptance of the 25 percent sampling methodology, despite identifying two periods of noncompliance, to be inconsistent with the state’s best interest.

In addition to the issues above, we found the vendor’s sampling methodology considered documentation that was not relevant to whether the performance metric had been satisfied because they did not involve an action that had to be taken by the vendor. This means that the sample of relevant documents was actually less than 25 percent.

The vendor stated it is in the process of implementing a new information technology feature that will identify all documents relevant to the performance metric. The vendor indicated that it will audit 100 percent of the documents relevant to the performance metric when the new feature is available. We note that failure to meet the three-day scheduling requirement in the contract is one basis for the Division to retain ten percent of the vendor's billings. In fact, in the instances noted above in which the Division retained ten percent of billings (nearly $800,000), it was for failure to meet this performance metric’s three-day requirement.

The second metric we identified as inadequate requires the vendor to provide the Division industry-accepted disability guidelines – or evidence-based treatment guidelines – for all claimants referred to a specialist within five days after the initial appointment. We found that the support documentation provided by the vendor does not include the information necessary for the Division’s State Contract Manager to determine if the vendor successfully addressed this performance metric. Our review found that the Division’s State Contract Manager and the vendor verbally agreed that the vendor would submit a weekly report containing the disability guidelines that were generated for the week. However, that report does not include the date of the initial appointment. Without the date of the initial appointment, the Division’s State Contract Manager cannot determine if the guidelines were supplied within five days of said appointment.

Performance metrics are designed to ensure the vendor maintains satisfactory performance levels throughout the duration of the contract. The Division should enforce the provisions of the contract to the fullest extent possible.

We urge the Division to require the vendor to provide all supporting documentation pertaining to the performance metrics and to perform an independent review prior to disbursing the retained billings.

Vendor's Failure to Oversee Compliance of Providers' Timely Reporting

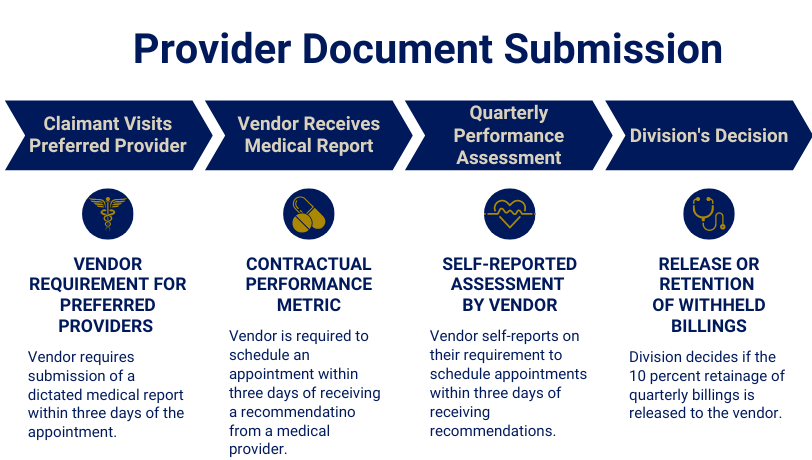

The performance metric that requires the vendor to schedule appointments within three days is based on when the vendor acts on the receipt of a recommendation from the provider and does not address reporting delays from the provider, similar to those identified during our medical report testing. This means the vendor can still satisfy the performance metric to schedule an appointment within three days of receipt of a medical recommendation even when there are delays in the submission of documentation. The chart below illustrates the operational flow of this performance metric.

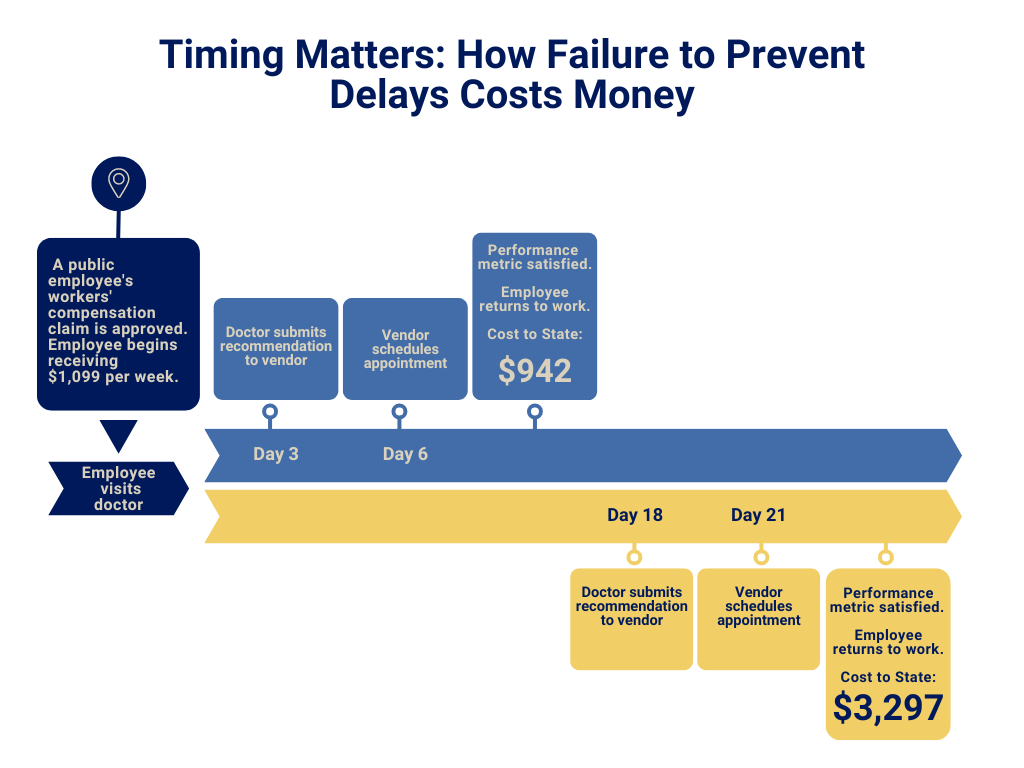

Absent an additional performance metric that requires medical providers to submit recommendations to the vendor within three days of the claimant’s appointment, the length and cost of a claim can be impacted significantly. The chart below provides a hypothetical scenario illustrating this point.

The Division should administer workers’ compensation claims efficiently to provide injured employees with the care they need, control costs, and ensure employees return to work as quickly as possible. Delays in medical provider recommendations result in public employees remaining out of work for unnecessarily long periods and undermine the State’s efforts to limit costs.

We note that the Provider Manual was included with the vendor’s response to the request for proposal in the prior contract, but was not included in the current contract. We recommend that the Division consult with its State Contract Manager and the Attorney General’s Office to determine if the vendor’s policies and procedures, such as the Patient Care Policies, and its effective terms are incorporated into the current contract and whether the Division can enforce provider recommendation deadlines. Further, for any extensions of this contract and any future contract solicited, we recommend including an additional performance metric to ensure the vendor obtains provider medical reports within an expressly defined reasonable timeframe as well as clearly defined reporting requirements to ensure proper documentation of each performance metric.

Additional Cost-Saving Measure

During our follow-up review, the Division advised that it had begun cost-saving measures involving case management. Specifically, in instances in which an injured worker reopens a workers’ compensation claim to pursue additional benefits, the vendor charges approximately $2,000 to administer the claim. The Division began administering and actively tracking a portion of reopened claims in July 2021. Our review found that the Division successfully managed and closed 222 reopened claims, resulting in savings of approximately $414,000. Furthermore, at the time of our follow-up review, the Division was still actively managing 103 reopened claims, representing a potential savings[6] of approximately $189,000. Collectively, the closed and open internal claims represent potential savings of approximately $603,000.

Recommendations

The Division has made limited progress addressing the recommendations contained in the 2020 Audit, and as detailed throughout this follow-up report, significant issues remain to be addressed by the Division.

With regard to Recommendation 1, we urge the Division to obtain legal guidance to interpret N.J.S.A. 34:15-37 and establish the appropriate methodology for calculating compensation payments. Additionally, we recommend that the Division updates its Manual and templates to establish policies and procedures that are consistent with the interpretation. Providing uniform guidance will aid in ensuring compliance with the law and reducing confusion and errors. Further, we urge the Division to provide training to human resource offices to reduce wage submission errors. Lastly, we recommend the Division consider the use of technological processes to obtain wage information directly, such as from the Department of Labor, to ensure proper wage data is used in the calculation of TWC payments.

With regard to Recommendation 2, we urge the Division to finalize formal policies and procedures to reduce payment errors through mandatory supervisory review of TWC calculations and to require the use of the internal TWC calculator in the Division’s claim management system.

With regard to Recommendation 3, we again recommend that the Division implement policies and procedures that effectively manage multiple claims to prevent potential abuse of the workers’ compensation program and to improve safety and accident prevention. To that end, we urge the Division to assess whether information technology can be leveraged to identify multiple claims by a single claimant or for a single location. Additionally, we recommend that the Division begin preparing its statutorily mandated accident frequency reports. We further urge the Division in consultation with the State Treasurer and Commissioner of the Department of Banking and Insurance to conduct Committee meetings at least quarterly, as required by law.

With regard to Recommendation 4, we again recommend that the Division develop formal policies and procedures to establish when individuals return to work and methods to identify individuals receiving overlapping benefits.

With regard to Recommendation 5, we again urge the Division to implement policies and procedures that require more frequent case file reviews and timely monitoring of claimants’ work status changes.

With regard to Recommendation 6, we again urge the Division to revise policies and procedures to improve claim management operations to prevent abuse and improve safety. These procedures should establish the criteria and protocols for authorizing the use of investigatory techniques, including, for example, the timing and frequency of site visits, witness interviews, and surveillance.

With regard to Recommendation 7, we urge the Division to require the vendor to provide all supporting documentation pertaining to the performance metrics, and to perform an independent review prior to disbursing the retained billings. We also recommend that the Division consult with its State Contract Manager and the Attorney General’s Office to determine if the vendor’s policies and procedures and all effective terms are incorporated into the new contract, and whether the Division can enforce provider recommendation deadlines. Further, for any extensions of this contract and any future contract solicited, we recommend including an additional performance metric to ensure the vendor obtains provider medical reports within an expressly defined reasonable timeframe as well as clearly defined reporting requirements to ensure proper documentation of each performance metric are submitted within the timeframe established in the Patient Care Policies.

Reporting Requirements

We provided a draft copy of this report to the Division for its review and comment. Its response was considered in preparing our final report and is attached as Appendix A. We note that during the follow-up review and in its response, the Division advised that it is in the process of replacing the computer system it uses to manage workers’ compensation claims. The Division provided us with a brief demonstration of the new system, which involves multiple areas other than workers’ compensation, and advised that programming for workers’ compensation claims management will begin in fall 2023. We were not able to test the new system or evaluate whether it will effectively implement the recommendations included in the 2020 Audit report.

By statute, we are required to monitor the implementation of our recommendations. To enable us to meet this requirement, within 90 days, the Division shall report to our office regarding the actions that have been or will be taken to address the unresolved issues in this report. We will continue to monitor those steps.

We thank the management and staff of the Division for the courtesies and cooperation extended to our auditors during this review.

Footnotes

[1] STATE OF N.J. OFFICE OF THE STATE COMPTROLLER, AUDIT REPORT: A PERFORMANCE AUDIT OF WORKERS’ COMPENSATION CLAIM MANAGEMENT (July 2020), (“2020 Audit”), https://www.nj.gov/comptroller/news/

docs/workers_comp_audit_report.pdf.

[2] FY 2023 claims and cost data were not available at the time of report publication.

[3] N.J.S.A. 52:18A-221.

[4] A permanency award is a type of workers’ compensation benefit provided to employees who suffer partial or total loss of a body function after a work injury.

[5] When we requested the vendor’s Preferred Provider Manual for our follow-up review, we were directed to the vendor’s website. The website listed multiple policy manuals, including the Patient Care Policies that established reporting expectations for participating physicians and other health care professionals. This is the manual that we reference for our follow-up review.

[6] The Division has the ability to send a reopened claim back to the vendor if the treatment becomes too complex to be managed internally, as such, savings are considered potential.

Press Contact

Pamela Kruger

Pamela.Kruger@osc.nj.gov

609-789-5094

Waste or Abuse

Report Fraud

Waste or Abuse

Official Site of The State of New Jersey

Official Site of The State of New Jersey