A Performance Audit of Selected Fiscal and Operating Practices: Township of Rockaway

- Posted on - 05/24/2023

Table of Contents

- Audit Authority, Background, and Executive Summary

- Audit Objectives, Scope, and Methodology

- Audit Findings and Recommendations

- Reporting Requirements

Audit Authority, Background, and Executive Summary

We performed this audit pursuant to the State Comptroller’s authority set forth in N.J.S.A. 52:15C-1 to -24. We conducted this performance audit in accordance with Generally Accepted Government Auditing Standards (GAGAS)[1] applicable to performance audits. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

The Township of Rockaway (Rockaway or Township) is located in Morris County and covers 41.73 square miles. Rockaway has approximately 25,300 residents. The Township operates under the Mayor-Council Plan form of government, comprised of a mayor and nine council members. The mayor serves as the chief executive and, with the business administrator, is responsible for enforcing ordinances and charter provisions and preparing the municipal budget.

The Township is a civil service municipality subject to civil service statutes. Rockaway’s 2021 independent audit reported its current fund with total income of $134.2 million and total expenditures of $129.5 million.

Our audit identified weaknesses with certain fiscal and operating practices. Specifically, our audit found that the Township:

- Allowed employee leave payments of $167,093 in violation of state law or Township policy;

- Failed to properly procure health insurance coverage and health insurance brokerage services;

- Did not change to the State Health Benefits Program (SHBP) for prescription coverage. This cost taxpayers an estimated $4.5 million from January 1, 2019 to December 31, 2021. The Township paid twice for benefits for retirees;

- Failed to adhere to its policies and procedures or state law in its payment of overtime; and

- Had $10.1 million in unspent and unencumbered funds related to projects more than five years old and balances for local improvements of $2.1 million. These funds are eligible for use to offset future taxation.

Rockaway must improve its current practices, revise and develop policies and procedures, and increase management oversight to achieve greater operational effectiveness and to comply with state and federal laws and its own internal policies and procedures.

We make 15 recommendations to improve Rockaway’s operations and its compliance with applicable statutes and regulations.

Audit Objectives, Scope, and Methodology

The objectives of our performance audit were to review the Township’s controls over selected employee benefits and fiscal and operating practices; assess its compliance with laws, regulations, and internal policies and procedures related to those practices; and identify opportunities for cost savings.

The period January 1, 2019 through December 31, 2021

We engaged a performance audit with Rockaway through a letter dated February 18, 2022. We held an opening conference with Township representatives on March 8, 2022. The purpose of the opening conference was to establish our audit authority, review our audit process with the Township, and obtain information. A survey phase of approximately two months followed this meeting in which we interviewed Township employees, reviewed Township records, and identified potential risk areas. We developed an audit plan for the significant risks we identified. On October 13, 2022, we presented our preliminary findings to the Township. The Township provided additional information in response to our preliminary findings. We reviewed that information and issued a draft of our audit report to the Township on January 25, 2023. On February 6, 2023, we held an exit conference with Township representatives. The Township requested and received two extensions to provide a response to our draft report. The Township provided its response on March 10, 2023. In its response, the Township agreed with some of our findings and disagreed with others and our characterization of waste. We corrected certain calculations, which are reflected in the report, but the majority of Rockaway’s response, while challenging some of our findings, did not provide sufficient and appropriate evidence to warrant any changes. We provided additional documentation to the Township and the Township provided an update to its prior response on April 14, 2023. Rockaway’s comments were considered in preparing our final report and are attached as Appendix A.

To accomplish our objectives, we reviewed relevant statutes, regulations, Township policies and procedures, collective bargaining agreements (CBAs), financial records, Board meeting minutes, and other supporting records. We also interviewed certain personnel to understand their job responsibilities, overall operations, and Rockaway’s internal controls.

GAGAS requires auditors to plan and perform audit procedures to assess internal control when internal control is determined to be significant to the objective. The Government Accountability Office’s Standards for Internal Control in the Federal Government,[2] or “Green Book,” provides a framework for internal control systems for public entities. The Green Book establishes five components of an internal control system: control environment, risk assessment, control activities, information and communication, and monitoring. The five components include 17 principles that support the effective design, implementation, and operation of an internal control system.

As part of our review, we selected a judgmental sample of records. Our samples were designed to provide conclusions about the validity of the sampled transactions, the adequacy of internal controls, and compliance with applicable laws, regulations, policies, and procedures. Because we used a non-statistical sampling approach, the results of our testing cannot be projected over the entire population of like transactions or contracts.

Audit Findings and Recommendations

A. Employee Leave Policies and Payments

Objective: To determine whether the Township processed leave payments in compliance with applicable statutes, regulations, CBAs, and individual employment contracts.

Findings

- CBAs and individual employment contract provisions allowed sick leave payments that exceeded the limits established by N.J.S.A. 11A:6-19.1 and N.J.S.A. 11A:6-19.2.

- CBAs and individual employment contract provisions allowed vacation leave carryover in excess of the limitations established by N.J.S.A. 11A:6-3(e).

- The Township allowed police employees to accumulate excessive holiday-related vacation leave without a contractual or statutory basis.

- Annual and terminal payments of $167,093 were made in violation of state law or Township policy.

Criteria

N.J.S.A. 11A:6-3(e), enacted in 1986, allows unused vacation leave for civil service employees to accumulate and be used during the next succeeding year only, except when a state of emergency has been declared by the governor. In 2007 and 2010, in an effort to reduce property taxes, the Legislature enacted laws that place limits on payments for unused sick leave. The 2007 and 2010 sick leave laws place restrictions on the timing and amount of payments to certain employees. The 2007 law, N.J.S.A. 11A:6-19.1, limits payments for unused sick leave to senior employees to the greater of $15,000 or the amount accumulated on the effective date of the law and only upon retirement. The 2010 law, N.J.S.A. 11A:6-19.2, limits payments for unused sick leave for employees hired after May 21, 2010 to no more than $15,000 and only upon retirement.

The State of New Jersey Commission of Investigation’s December 2009 report, “The Beat Goes On: Waste and Abuse in Local Government Employee Compensation and Benefits”[3] commented on the leave provisions in the Township’s CBAs. The report cited inflated caps on the accrual and redemption of sick leave and specifically identified the excessive leave provisions available to the Township’s police employees. In July 2022, OSC released a report, “A Review of Sick and Vacation Leave Policies in New Jersey Municipalities”[4] which found widespread noncompliance with the laws on sick and vacation leave payments.

The Township’s 2020 and 2021 independent audit reports include the recommendation that the Township consult with its attorney to ensure that its negotiated labor contracts, individual employment agreements, and policies are in accordance with New Jersey statutes regarding unused sick and vacation leave.

Methodology

To meet this objective, we:

- Interviewed personnel responsible for leave payment administration;

- Reviewed CBAs, the Township’s Policy and Procedure Manual (Manual), the business administrator’s employment contract, and relevant state laws regarding employee accumulated leave administration and payment;

- Analyzed accumulated leave time and payroll reports;

- Judgmentally selected a sample of unused accumulated leave time payments from 2019 through 2021; and

- Requested and reviewed documentation supporting the payments.

Audit Results

Contracts, Policy, and Manual Review

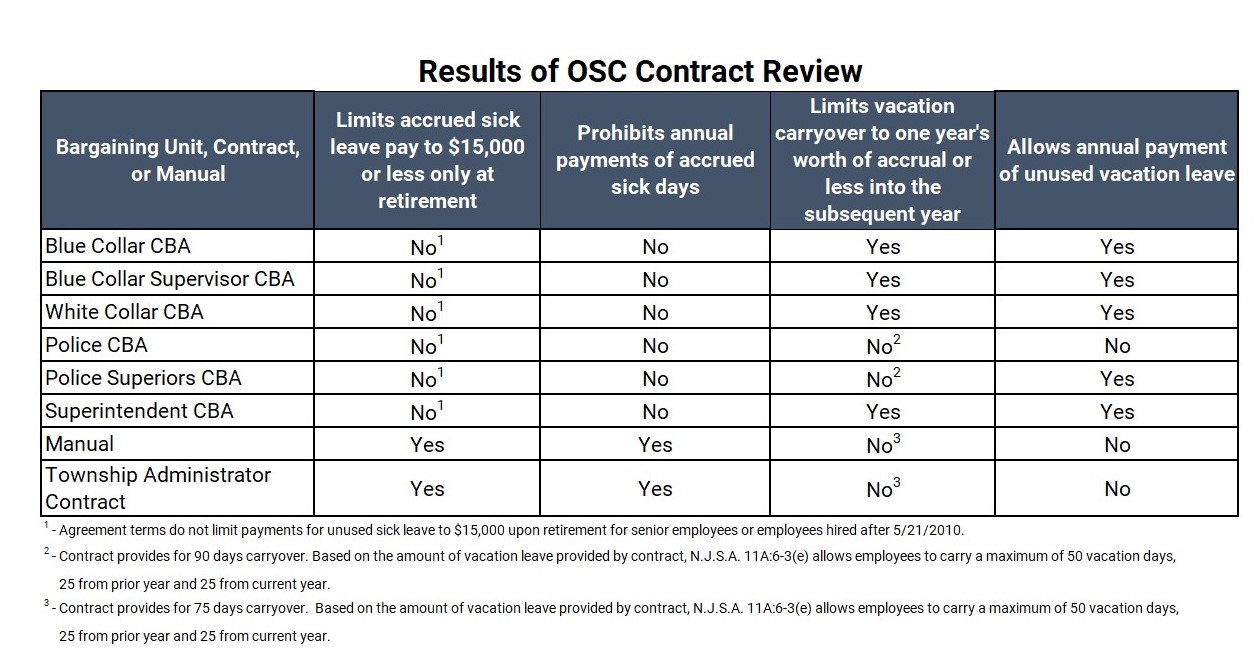

The Township’s six CBAs, one individual employment contract, and Manual include multiple provisions that are inconsistent with state law. The table below shows the results of our review.

As identified in the table above, the six CBAs do not limit the payment of sick leave for employees hired after May 21, 2010 to $15,000 and only upon retirement. The CBAs allow employees to receive payments for unused sick leave on an annual basis. The CBAs prohibit payments for unused sick leave at retirement for non-police employees hired after January 1, 1999 and police employees hired after January 1, 2015. CBAs for police employees permit employees hired after May 21, 2010 but before January 1, 2015 to receive payments at retirement that are prohibited by law.

The provisions in the Manual, which apply to employees not covered by a CBA, allow payment for accumulated sick leave to retiring employees with ten or more years of service and in accordance with state law. The Manual failed to document the statutory requirements that limit unused sick leave payments to $15,000 for senior employees and employees hired after May 21, 2010. By simply referring to state law and not identifying what state law requires, the Manual presumes that employees responsible for administering the payments will either know or research state law on this topic, which unnecessarily increases the risk that the law will not be followed.

Two police CBAs, the business administrator’s employment contract, and the Manual allow for carryover of vacation leave in excess of the one-year carryforward limitations in N.J.S.A. 11A:6-3(e). The employment contract for the business administrator provides the administrator with the same benefits provided in the Manual. The police CBAs, the Manual, and the business administrator’s contract each provided for a maximum annual vacation leave allowance of 25 days. Under N.J.S.A. 11A:6-3(e), an employee may have at most two years’ worth of vacation at any time, which here would be 50 days, with an exception for a declared state of emergency. The Manual allowed employees to carry over up to 75 unused vacation days from year to year. The police CBAs allowed employees to carry over a maximum of 90 days of unused vacation. The CBAs, employment contract, and the Manual explicitly exceed the amount of accumulated vacation leave allowed by law.

We note that in March 2022, during our audit, the Township updated the Manual vacation leave policy by restricting vacation accruals to two years “for all employees hired after May 21, 2010.”

However, the vacation accrual statutory limit under N.J.S.A. 11A:6-3(e) applies to all employees, not just those hired after May 21, 2010. The statute limiting vacation accrual for civil service municipalities has been in existence since 1986.

The Township also provides annual payments for unused vacation leave. For example, the superior officer’s CBA allows eligible officers to receive payment for up to 25 unused days annually. State law has been interpreted to allow annual payments for unused vacation leave,[5] however permitting this practice exceeds what state employees are allowed and undermines the Legislature’s goal of standardizing vacation leave benefits at different levels of government.[6]

Unused Vacation Leave Accumulation

As of December 31, 2021, we identified 32 of 219 Township employees that accumulated vacation leave in excess of the statutory two-year limit. This leave is valued at $485,354. In addition, for that same period, five employees received $81,312 in excess of the statutory limit for unused vacation leave payments at separation.

In addition to the annual allocation of vacation leave to employees, the Township’s police CBAs award vacation leave in lieu of providing employees leave on official township holidays. The Township’s police and police supervisors’ CBAs state that “members of the Department will be granted twelve (12) - holidays which shall be taken as part of their vacation time during the current year of the contract.” (Emphasis added.) The contract indicates that the leave time must be used during the year granted and does not provide any basis for the accumulation or payment for such leave. This vacation leave is subject to the carryover restrictions of N.J.S.A. 11A:6-3(e). The value of the Township’s unused vacation leave awarded in lieu of a holiday was approximately $3.5 million as of December 31, 2021.[7]

Until the Township enforces the holiday-related vacation leave provisions in its CBAs, the costs of unused leave will continue to increase with every annual pay raise and promotion for its police employees and result in inflated payments at retirement. For example, a new police officer hired on January 1, 2018 would receive approximately $2,500 dollars in holiday-related vacation leave available at the start of employment. At the end of 2021, the value of that same leave time, if unused, based on an officer’s increase in salary, would increase to approximately $4,950. This represents an increase of 89 percent over four years, which would be expected to grow substantially over the decades of a police officer’s career. This inflated payment provides incentive for employees to allow the leave to accumulate.

As of December 31, 2021, five senior police employees, including the police chief, had accumulated $1.17 million in unused holiday-related vacation leave, an average of approximately $234,000 per employee. This is in violation of the law and CBAs, which require the leave to be taken by employees “as part of their vacation time during the current year of the contract.” The Township can limit large payments for unused leave at retirement by administering the leave in accordance with its CBAs and complying with the carryover restrictions of N.J.S.A. 11A:6-3(e).

Examination of Unused Leave Payments

We reviewed employee accumulated leave reports to determine the Township’s compliance with CBAs, state law, and its own policies governing leave accrual and unused leave payments. We identified 43 employees that received 99 payments, other than at separation of employment, for approximately 18,300 hours of combined unused leave time (vacation, sick, and holiday/personal) with a value of $1 million. We identified 25 employees that received payments at separation of employment for almost 25,800 hours of various types of accumulated leave valued at $1.6 million.

We judgmentally selected 25 annual leave (vacation, sick, and personal) payments to determine whether the Township made the payments in accordance with state law and CBA provisions and whether the payments were subjected to management review. Of the 25 annual leave payments tested, we found:

- Six payments for five employees, including the chief financial officer (CFO), lacked the appropriate approvals.

- Five annual leave payments totaling $69,687 for the police chief, CFO, and tax assessor did not comply with Township policy and procedures. This total consisted of vacation leave ($11,416), personal leave ($948), and sick leave ($57,503). The Manual governing these employees does not authorize payments for unused sick leave other than at retirement.

- We found that 2 of the 25 annual leave payments violated the sick leave provisions of the 2007 and 2010 laws. The police chief, CFO, and tax assessor all received annual sick leave payments of $31,518, $14,568, and $11,416, respectively. The payments to the CFO and tax assessor would be lawful if otherwise authorized by the governing body because those employees were hired prior to May 21, 2010 and the 2007 law expressly exempts CFOs and tax assessors, among others, from the sick leave limitations placed on senior employees.

We found that annual sick leave payments made to the Rockaway police chief violated the 2007 law on sick leave. Because the police chief is by ordinance subject to advice and consent of the governing body, which is the threshold standard included in the 2007 law, the police chief is barred from receiving the payments. The application of that law to the police chief should be addressed by the Township in accordance with N.J.S.A. 11A:6-19.1, which directs governing bodies of local governments subject to that law to address its application “in an adopted ordinance or resolution, pursuant to guidelines or policy that shall be established by the Local Finance Board in the Department of Community Affairs.” The Township has adopted an ordinance related to the 2007 law that addresses pension eligibility, but that issue is not relevant to the application of the sick leave provisions in the 2007 law. Guidance issued by the Division of Local Government Services (DLGS) within the state Department of Community Affairs states that the sick leave limitations apply “regardless of their pension system affiliation” and “also affect individuals that serve in both Civil Service (Title 11A) and non-Civil Service local units; both are treated the same.” The Division of Local Government Services confirmed that the position of police chief for Rockaway meets the criteria for inclusion under the 2007 law restricting payments for unused sick leave to only upon retirement. The Division noted that a person who has principal operating responsibility of a government function (commonly called “department head” or similar title) who is appointed by the governing body or a municipal or county manager, as applicable to the form of government, and who directly reports to an elected official or chief administrative officer is covered by the 2007 law. Payments to the police chief for unused sick leave were $47,433 for the period 2019 through 2021.

We reviewed all 25 payments made upon termination of employment and found:

- Five employees received payments totaling $81,312 for unused vacation leave in excess of two years of vacation leave at termination. The payments exceeded statutory vacation leave payment limits under N.J.S.A. 11A:6-3(e). Payments to two of the five employees exceeded the 90-day unused vacation limitation by $959 according to the Township’s CBAs.

We also found that the Township has not taken effective corrective action to remediate deficiencies in its sick and vacation leave policies and contract provisions identified in audits and oversight reports. In 2020 and 2021 audit reports, the Township’s auditors recommended that the Township consult with its attorney to ensure that its negotiated labor contracts, individual employee agreements, and employee policies, as applicable, are in accordance with state law regarding unused sick and vacation leave. Management is required to remediate identified internal control deficiencies on a timely basis.[8] We found, as described in detail above, that corrective action has been insufficient to ensure compliance with statutory sick and vacation leave requirements.

In sum, the Township has adopted CBAs and maintained policies that are inconsistent with state law, exposed taxpayers to excessive payments for employee leave, and tolerated practices that resulted in inflated supplemental payments. The Township’s policies and practices related to sick leave are unlawful and wasteful.

Cause

Township CBAs and the Manual contain provisions that are inconsistent with statutory requirements. Management has not taken effective corrective action to remediate deficiencies in its employee sick and vacation leave policies and contract provisions identified in audits and oversight reports.

Effect/Potential Effect

The Township’s CBAs, Manual, and practices created an environment allowing excessive accrual of vacation leave valued at $485,354 and improper payments of $167,093 for accumulated employee leave time. As of December 31, 2021, five senior police employees, including the police chief, have accumulated $1.17 million in unused holiday-related vacation leave, an average of approximately $234,000 per employee.

Recommendations

- Ensure that provisions in CBAs, individual employment contracts, and the Manual, as applicable, include (1) terms that limit payments for unused sick leave for senior employees and those hired after May 21, 2010 to $15,000, payable only upon retirement from a pension system, and (2) terms that restrict vacation leave carryover, including vacation leave received in lieu of holidays, consistent with state law for local governments in the civil service system.

- Ensure compliance with 2007 and 2010 laws on sick leave, evaluate annual and terminal leave payments, and assess the potential to recoup improperly paid balances in consultation with appropriate Township professionals. Demand recoupment of unlawful payments. Document facts and positions taken during this evaluative process and document efforts to recover funds.

- End the practice of allowing holiday-related vacation leave to accumulate without restriction. Obtain written legal advice regarding the enforcement of existing contractual provisions. The advice should include an examination of existing CBA language to determine the contractual limitations for this leave as well as the application of the carryover limitations of N.J.S.A. 11A:6-3(e). The Township should prepare a memorandum regarding this issue that explains the decision it made based on the advice received.

- Adjust accumulated leave records for employees whose leave time exceeds the limit established by N.J.S.A. 11A:6-3(e). Seek guidance from Township professionals regarding how to implement the necessary adjustment. Document decisions and reasons for these decisions during this process. As needed, pursue relief through available dispute resolution processes.

- Determine, in accordance with N.J.S.A. 11A:6-19.1, whether any other employees subject to advice and consent of the governing body are subject to the sick leave limitations in that law and adopt a resolution or ordinance. Obtain written legal advice regarding this issue and document facts and positions taken during this evaluative process.

B. Insurance Contracts Procurement

Objective: To determine whether the procurement of health insurance coverage and health insurance brokerage services complied with applicable statutes and regulations.

Findings

- The Township’s procurement of health insurance coverage and health insurance brokerage services did not comply with N.J.A.C. 5:34-2 or the Township’s own policy.

- The Township failed to obtain required vendor disclosures, a New Jersey Business Registration certificate, and other required forms from its health insurance broker in compliance with applicable laws.

- The health insurance broker did not have a written contract and failed to disclose commissions for the Township’s health insurance policies in writing in violation of N.J.S.A. 17:22A-41.1(a).

Criteria

Pursuant to N.J.S.A. 40A:11-5(1)(m), a contract involving insurance, including the purchase of health insurance coverage and consulting services, is exempt from bidding, but must comply with requirements in the statute involving extraordinary unspecifiable services. An extraordinary unspecifiable service is a service that is specialized and qualitative in nature requiring the service provider to have expertise, extensive training, and a proven reputation in the industry. The Township can award an extraordinary unspecifiable service contract in excess of the bid threshold by documenting efforts to secure competitive quotations and having an official file a certificate with the governing body describing the nature of the contract and the informal solicitation of quotes.

For insurance contracts, a governing body may simply cite to the statutory reference designating insurance and insurance broker contracts as an extraordinary unspecifiable services. Like any other contract, the governing body must also award the contract by resolution and cause to be printed in its official newspaper a brief notice stating the nature, duration, service, and amount of the contract. The notice is also required to state that the resolution and contract are on file and available for public inspection in the office of the clerk of the county or municipality.

In addition to the Local Public Contracts Law, a municipality must comply with the Pay to Play Law. N.J.S.A. 19:44A-20.5 prohibits a municipality from entering into a contract valued in excess of $17,500 with a business entity unless the municipality has followed the Fair and Open Process or the intended awardee has not made a disqualifying political contribution in the preceding year. The Township incorporates this requirement in its Purchasing Manual.

A fair and open process requires that the contract be (1) publicly advertised in newspapers or on its website in advance of the contract; (2) awarded under a process that provides for public solicitation of proposals or qualifications and awarded and disclosed under criteria established in writing by the public entity prior to the solicitation of proposals or qualifications; and (3) publicly opened and announced when awarded. N.J.S.A. 19:44A-20.26 requires the disclosure of political contributions no less than 10 days prior to entering into a contract in excess of $17,500 that does not meet the fair and open process requirements. This is commonly referred to as a “non-fair and open process.”

N.J.S.A. 17:22A-41.1(a) requires a licensed insurance producer who sells, solicits, or negotiates health insurance policies or contracts to notify the purchaser, in writing, of the amount of any commission, service fee, brokerage, or other valuable consideration that the producer will receive.

The Township must also obtain a Business Registration Certificate, Ownership Disclosure form, Affirmative Action/Equal Employment Opportunity Certificate, and Disclosure of Investment Activities in Iran form from the broker.

Methodology

To meet this objective, we:

- Interviewed personnel responsible for procurement;

- Reviewed purchasing policies and procedures;

- Examined the Local Public Contracts Law and other relevant statutes and regulations; and

- Examined the Pay to Play Law.

Audit Results

The Township used, but never retained, a health insurance broker to solicit quotes for employee prescription, dental, and vision insurance benefits. As of 2021, contracts for prescription, dental, and vision insurance benefits were valued at $1,966,866, $964,205, and $115,274, respectively. The Township did not have a written contract with the broker. Rockaway officials reported they did not believe that a formal procurement process was required because the Township did not compensate the broker directly. We confirmed that the Township did not follow any authorized procurement process to retain the broker. The Township could not provide evidence that it sought competitive quotes for vendors to provide health insurance broker services. We determined that commissions paid in 2021 to the broker in conjunction with the Township contracts were approximately $93,500 for prescription, dental, and vision coverage, which is in excess of both the political contribution disclosure threshold of $17,500 and the Township’s bid threshold of $44,000.

In addition to failing to obtain competitive quotes, the Township did not (1) award the contract with the brokerage firm through a resolution and thus did not provide the required transparency; (2) complete the required extraordinary unspecifiable service certification; (3) publish the contract award in the newspaper; (4) obtain disclosure of any disqualifying political contributions from the broker; or (5) obtain the required compliance documents from the broker (including disclosure of the ownership of the brokerage firm, a certification that the broker is not involved in investment activities in Iran, a Business Registration Certificate, and Affirmative Action/Equal Employment Opportunity Certificate). The Township did not meet the requirements of a fair and open process stated in the criteria above and did not obtain the required political contribution disclosures.

The Township provided the broker’s commission information for 2021. However, we did not receive proof that the broker disclosed the commission information in writing to the Township prior to the commencement of services.[9] Not receiving the broker information at all or receiving it late prevents council members from taking into account that brokers who receive fees dependent on the amount of health insurance premiums could face conflicting incentives in seeking lower cost health insurance alternatives for their clients. We received 2019 and 2020 commission information only after requesting the information from the insurance broker directly. We confirmed that the broker’s commissions of $93,800 in 2019 and $93,600 in 2020 exceeded the Township’s bid threshold in both years.

The Township provides medical benefits to its employees through the SHBP. Employee prescription, dental, and vision coverage is provided by private insurance companies. We reviewed the current health insurance vendor contracts. We requested but did not receive from the Township competitive quotes or proof of a documented effort to obtain them despite all the vendors exceeding the bid threshold. In addition to failing to comply with the Local Public Contracts Law, the Township did not meet the requirements of a fair and open process. The Township failed to obtain the required political contribution disclosures for all of the vendors. Finally, the Township did not include documentation demonstrating that it had published in a newspaper a notice of contract award for its procurement of dental coverage in 2021.

Cause

The Township failed to follow many requirements of the Local Public Contracts Law and the Pay to Play Law in its procurement of a health insurance broker and health insurance contracts.

Effect/Potential Effect

Rockaway’s noncompliance with the Local Public Contracts Law resulted in improperly awarded contracts and a lack of transparency in spending. In addition, the Township may not have procured the lowest prices for insurance coverage because of Rockaway’s failure to obtain competitive quotes.

Recommendations

6. Comply with the requirements of the Local Public Contracts Law, including N.J.A.C. 5:34-2, for the procurement of insurance and insurance services.

7. Obtain political contribution disclosures for contracts with values in excess of $17,500 or comply with the fair and open process.

8. Amend the Township’s purchasing policy to include additional details regarding extraordinary unspecifiable service procurements such as requiring the solicitation of quotes, filing of the required certificate with the governing body, approving the contract by governing body resolution, and requiring contract description in advertisement.

C. Health Benefit Plan Cost Savings

Objective: To determine whether the Township could have saved money by participating in the SHBP for prescription coverage.

Findings

- Rockaway overspent approximately $4.5 million in prescription plan costs.

- The Township could have saved $1.4 million by obtaining prescription coverage for current employees through the SHBP instead of a private insurance carrier.

- By providing duplicative prescription plan coverage to retirees, the Township wasted $3.1 million.

Criteria

Waste is the act of using or expending resources carelessly, extravagantly, or to no purpose. Importantly, waste can include activities that do not include abuse and does not necessarily involve a violation of law. Rather, waste relates primarily to mismanagement, inappropriate actions, and inadequate oversight.

Methodology

To meet this objective, we:

- Interviewed personnel responsible for procurement;

- Reviewed CBAs terms regarding health benefit coverage;

- Reviewed the health insurance broker’s analysis from 2021 for prescription drug coverage; and

- Compared the Township’s prescription insurance premiums with premiums for comparable coverage in the SHBP to assess whether the Township could have saved money by participating in the SHBP.

Audit Results

Prescription Plan Cost Analysis

Our analysis compared the premiums of the Township’s private prescription insurance coverage for current employees with the rates for comparable coverage in the SHBP from January 1, 2019 through December 31, 2021. We determined the amount the Township would have paid if current employees were enrolled in the SHBP by using the January invoice for each year. We found the comparable SHBP prescription rate for each individual on the invoice, added the comparable rates for all individuals, and projected that amount over 12 months. We compared the total projected amount to the Township’s costs for private insurance coverage for current employees for the same period. We determined that the Township could have saved $1.4 million by obtaining prescription coverage for current employees through the SHBP instead of through its private insurance carrier.

Duplicate Prescription Coverage

During our review, we also found that the Township contracted with both the SHBP and a private insurance vendor to provide duplicative prescription coverage to many Township retirees, a practice that had been occurring since at least 2008. A review of January 2021 invoices identified 143 out of 151 retirees were receiving dual prescription coverage. For the three-year period 2019 through 2021, maintaining duplicate prescription insurance for retirees resulted in waste of $3.1 million.

The Township provides two insurance prescription plans to retirees because, until recently, the SHBP did not permit local governments to provide health insurance to retirees without also obtaining prescription coverage. In addition, the Township is contractually prohibited from eliminating the private prescription benefits for retirees without negotiating to do so. The Township acquiesced to this wasteful spending by not seeking to negotiate and avoid the double prescription coverage.

Employees who meet certain eligibility criteria and receive SHBP medical coverage through their employers are automatically enrolled in both the SHBP medical and prescription coverage by the New Jersey Division of Pension and Benefits at retirement based on the State’s policy and the Township’s CBAs. Prior to January 30, 2020, local government employers could only offer SHBP medical plans combined with an SHBP prescription drug plan to retirees. On January 30, 2020, the State Health Benefits Commission approved a change to the prescription coverage options that allows employers offering retirees prescription coverage through a private vendor to continue to do so without providing duplicate prescription coverage through the SHBP. This provides an avenue through which a local government employer can avoid the duplication of prescription benefits and meet its contractual obligations related to the provision of private insurance.

All six of the Township’s CBAs specifically require the Township to negotiate with its employees and retirees prior to altering their insurance benefits. In the absence of a collectively bargained amendment to the CBA, the Township agreed to maintain the private prescription coverage, which provides benefits on terms that are different from those of the SHBP prescription plan. The current prescription plan provides retirees with lower co-payments, unrestricted access to certain drugs, and no requirement to select generic over name brand medications.

The combination of the state’s automatic enrollment of retirees in the SHBP prescription plan and the Township’s contractual obligations to provide retirees the same prescription plan in retirement led the Township to provide and pay for two prescription plans for many of its retirees. There is no indication that the Township sought to avoid this wasteful result through collective bargaining at any time from 2008 to the present. We requested documentation of any negotiations in which the Township sought to avoid the duplicative coverage. We received documentation for current contract negotiations only, and no documentation was provided for negotiations regarding existing retirees. Township officials informed us that they made a number of calls to the State to request discontinuing the duplicate SHBP coverage but were unable to accomplish that goal.

The Township did not provide a plan for eliminating waste for existing retirees but stated that it has taken steps to reduce it for new retirees. According to the Township, costs have been reduced in part by encouraging new retirees, many of whom are required to contribute toward the cost of their benefit coverage in retirement, to discontinue the higher cost private prescription coverage. Township officials have also proposed that the SHBP administer prescription benefits in recent CBA negotiations that would eliminate the duplicate benefits for future retirees. Also, the Township’s CBAs require that police employees hired after January 1, 2015 and non-police employees hired after January 1, 2011 contribute the total premium cost to receive health benefits upon retirement. This will limit the costs to taxpayers when these employees retire in the coming decades.

In sum, we determined that, from 2019 through 2021, $3.1 of the $4.5 million in excessive costs stated earlier was attributable to the duplicative prescription coverage provided to retirees through both the SHBP and the Township’s private insurance carrier.

Cause

The Township’s provider’s plan remained in effect due to the failure of the municipality to renegotiate restrictive language in Township CBAs and the State’s now-revised policy regarding retiree benefits.

Effect/Potential Effect

The Township failed to reduce spending by an estimated $4.5 million for prescription costs: $1.4 million by not enrolling in the SHBP prescription plan for active employees and $3.1 million due to duplicate prescription coverage for retirees.

Recommendations

9. Conduct an analysis to evaluate the costs and benefits of switching to the SHBP for prescription coverage for current employees.

10. Based upon this analysis, seek to implement the most cost-effective means of providing employee health benefits through collective bargaining. Substantiate any analysis performed and collective bargaining negotiations with written documentation.

11. Eliminate duplicate prescription insurance coverage to Township retirees.

D. Overtime Compliance

Objective: To determine whether the Township was administering overtime benefits in compliance with federal and state regulations and Township policies and procedures.

Finding

Rockaway did not adhere to its policies and procedures or the New Jersey Wage and Hour Law in its payment of supplemental pay.

Criteria

Township CBAs provide opportunities for employees to supplement their wages. Township policies and procedures require the approval of supplemental work and documentation in a Time-Off/Payroll Exceptions form that includes the employee name, date of submission, type of time off or payroll exception, date of time used, purpose, and supervisor and department head approvals. The department sends the completed forms to the payroll department. N.J.S.A. 34:11-4.2 requires payment to employees to be made no later than 10 days after a pay period ends.

Methodology

To meet this objective, we:

- Interviewed personnel responsible for payroll;

- Obtained employee payroll records;

- Examined federal and state laws related to overtime, including the Fair Labor Standards Act[10] (FLSA);

- Reviewed policies and procedures and CBA provisions related to supplemental pay;

- Selected a judgmental sample of employees receiving supplemental pay; and

- Requested and reviewed supplemental pay documentation for compliance with Township policies and procedures, FLSA requirements, and state requirements for the timely payment of wages.

Audit Results

The Township has adequate policies and procedures governing supplemental pay. The policies outline the relevant requirements of the FLSA, such as defining a workweek and timekeeping requirements, as well as the process for tracking and documenting supplemental employee pay and leave time usage. We judgmentally selected a sample of 28 of 171 police and public works department employees that received supplemental pay in 2021. Our testing included verification of 29 employee payroll transactions. We found exceptions with 19 of the 29 employee transactions selected; of the 19 transactions that had an exception, we documented 24 total exceptions for the reasons shown in the chart below.

|

Types of Exceptions |

||||

|

Payment of Undocumented Time |

Delayed Payment |

Omission of Reason for Overtime |

Missing Supervisory Approval Signatures |

Total Exceptions Found |

|

1 |

9 |

5 |

9 |

24 |

We also found that one employee had earned 32 hours of compensatory time in 2019 and 32 hours in 2020 for police training instruction. The Township did not credit the 64 hours to the employee’s compensatory time balance until January 2021. Rockaway failed to provide evidence of supervisory approval on a payroll exception form when the compensatory time was earned and could not provide an explanation as to why the police chief did not approve the time until 2021.

Cause

Rockaway did not consistently follow its own policies and procedures when authorizing and paying supplemental wages.

Effect/Potential Effect

Without appropriate management oversight and monitoring, an inconsistent approval process for supplemental work may lead to unauthorized or excessive payments or compensatory time to employees.

Recommendation

12. Develop policies and procedures for the payroll department that require the timely submission and verification of Time-Off/Payroll Exceptions forms. The policy should require that the Time-Off/Payroll Exceptions forms accurately document supplemental hours worked, provide justification for the supplemental work performed, and contain appropriate approval signatures prior to payment of supplemental pay.

E. Reserve Balances

Objective: To determine whether the Township’s reserve balances serve a necessary business purpose and the amounts reserved are appropriate.

Findings

- Capital project funds, many authorized over 20 years ago, remain unused.

- The Township had $10.1 million in unspent and unencumbered funds related to projects authorized more than five years ago.

- Surplus balances exist in the trust assessment and utility trust assessment funds of $1.9 million and $112,000, respectively.

Criteria

DLGS provides technical and financial assistance to municipalities for issues in budgeting, financial reporting, and management. In its Best Practices inventory[11] for 2011, 2020, and 2021, DLGS asked municipalities whether a review of unspent capital balances for cancellation was completed. Rockaway responded that it had performed a review in each of those three years.

DLGS issued Local Finance Notice 2020-11[12] to guide municipalities on adapting to the circumstances caused by COVID-19. The Local Finance Notice recommends that municipalities review all fully funded, unspent bond ordinance line items and identify any remaining balances that are not committed or under contract. The unspent balances are eligible for cancellation through ordinance or resolution, making them available for use to fund a debt service reserve or finance the cost of any other purpose or purposes for which bonds may be issued.

In Rockaway’s 2021 audit, the Township’s independent auditor recommended that the Township review older improvements in the general and utility capital funds with unexpended balances for possible cancellation.

Methodology

To meet this objective, we:

- Interviewed Township personnel responsible for finance and administration;

- Analyzed reported liability, reserve, and surplus balances as of December 31, 2021;

- Judgmentally selected a sample of liabilities, reserves, and surplus balances; and

- Reviewed documentation supporting the purpose and amount of the balances.

Audit Results

We performed an analysis of various liability, reserve, and surplus balances presented in the Township’s 2021 independent audit. We judgmentally selected 6 of the 76 balances totaling approximately $30.5 million for review: a $6.2 million reserve for tax appeals; a $6.1 million reserve for accumulated absences; two trust assessment fund surplus balances totaling $2.1 million; and funded improvement authorization balances in each the general capital and utility capital funds of $13.2 million and $2.9 million, respectively.

Reserves for Tax Appeals and Accumulated Absences

We determined that the reserves for tax appeals and accumulated absences served a necessary business purpose. We also determined that the amounts were appropriate.

Capital Improvement Projects

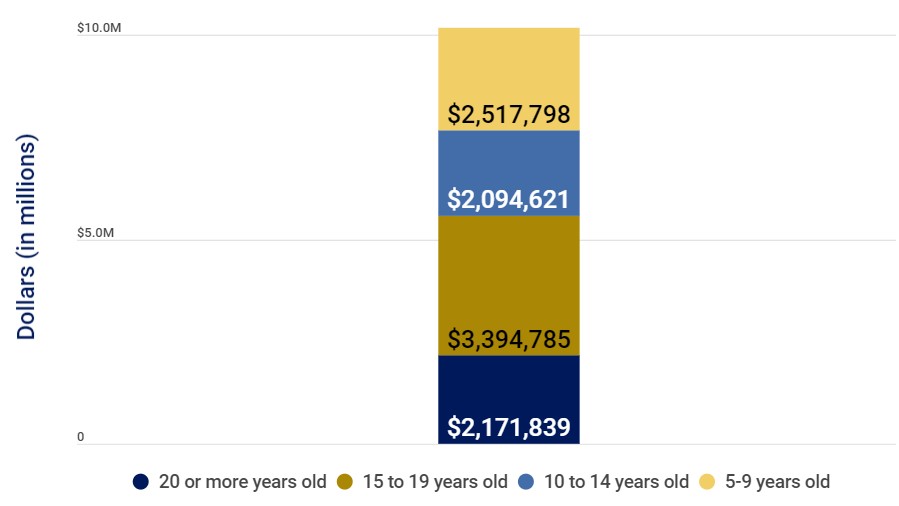

We used Township accounting records and recent audit reports to identify capital improvement projects that were at least five years old with funded balances as of December 31, 2021. We found that $10.1 million of the $16.1 million in funded improvements reported were greater than five years old, unspent, and unencumbered. Township officials have indicated that they intend to repurpose the balances for use in future projects. The chart below contains the funded balances greater than five years old summarized by the age of the original ordinance.

Local Improvement Projects

Our review of the 2021 audit liability, reserve, and surplus balances noted surplus balances in the trust assessment fund of $1.9 million and utility assessment fund of $112,000. These balances are eligible for anticipation as an item of revenue in the municipal budget for tax reduction.

Cause

The Township did not appropriately repurpose all unused capital improvement and assessment surplus balances when the funding was no longer required for their original purpose.

Effect/Potential Effect

Prior tax levies were greater than necessary to meet actual municipal needs. Projects approved many years ago may not be consistent with current Township priorities or needs. Unused funds may be susceptible to waste.

Recommendations

13. Develop and implement a process to report the status of each ongoing capital project to the governing body. This report should include information such as the adoption date of the ordinance, project expenditures to date, unspent project appropriations, and the project’s anticipated completion date.

14.Perform and document a review of capital project balances greater than five years old to determine if unencumbered and unexpended balances remain necessary for their original purpose. Repurpose unneeded capital balances in a manner allowable under law.

15. Seek advice from the Township attorney or auditor for allowable methods to dispose of the trust and utility assessment funds surplus balances, select the method most beneficial to the Township’s taxpayers, and dispose of surplus balances.

Reporting Requirements

We are required by statute to monitor the implementation of our recommendations. In accordance with N.J.A.C. 17:44-2.8(a), within 90 days following the distribution of the final audit report, the Township is required to provide a plan detailing the corrective action taken or underway to implement the recommendations contained in the report and, if not implemented, the reason therefore. We will review the corrective action plan to evaluate whether the steps taken by the Township effectively implement our recommendations.

We thank the management and staff of Rockaway for the courtesies and cooperation extended to our auditors during this engagement.

Footnotes - All links were last accessed on the report issuance date

[1] UNITED STATES GOVERNMENT ACCOUNTABILITY OFFICE, GOVERNMENT AUDITING STANDARDS 2018 REVISION, (Apr. 2021), (“GAGAS” or “Yellow Book”), https://www.gao.gov/assets/gao-21-368g.pdf.

[2] UNITED STATES GOVERNMENT ACCOUNTABILITY OFFICE, STANDARDS FOR INTERNAL CONTROL IN THE FEDERAL GOVERNMENT (SEPT. 2014) (“Green Book”), https://www.gao.gov/assets/gao-14-704g.pdf.

[3] S. 4, 214th Leg. (N.J. 2010), (“2010 law”), https://www.njleg.state.nj.us/2010/Bills/AL10/3_.HTM.

[4] STATE OF N.J. OFFICE OF THE STATE COMPTROLLER, A REVIEW OF SICK AND VACATION LEAVE POLICIES IN NEW JERSEY MUNICIPALITIES, 13-14 (July 2022), (“Sick and Vacation Leave Report”) https://www.nj.gov/comptroller/news/docs/sick_leave_report.pdf.

[5]In re Twp. of Mount Holly, P.E.R.C. No. 2011-41, 36 N.J.P.E.R. ¶164, 2010 PERC LEXIS 295 (2010); see also Newark, P.E.R.C. No. 2021-02, 2020 NJ PERC LEXIS 114 at 10.

[6] STATE OF N.J. OFFICE OF THE STATE COMPTROLLER, A Review of Sick and Vacation Leave Policies in New Jersey Municipalities at 3.

[7] In response to initial comments received from the Township, we provided Rockaway additional documentation to support calculated balances in our report. In the process of doing so, we found that retired Township employees remained on unused leave records used to calculate the liability for unused holiday leave in our draft report. Consequently, the liability decreased from $3.9 million to $3.5 million in this report to reflect payments to employees who retired in 2021.

[8] U.S. GOVERNMENT ACCOUNTABILITY OFFICE, Standards for Internal Control in the Federal Government at 9.

[9] See 29 U.S.C. §1108(b)(2)(B)(iii)(IV)(aa).

[10] FAIR LABOR STANDARDS ACT, 29 U.S.C. § 201 et al; see also 29 C.F.R. 553, (“FLSA”).

[11] STATE OF N.J. DIVISION OF LOCAL GOVERNMENT SERVICES, 2011-2021 BEST PRACTICES SURVEY SUMMARY, (Feb. 2022), https://www.nj.gov/dca/divisions/dlgs/programs/best_practices.html.

[12] Available at: https://www.nj.gov/dca/divisions/dlgs/lfns/20/2020-11.pdf.

Press Contact

Pamela Kruger

Pamela.Kruger@osc.nj.gov

609-789-5094

Waste or Abuse

Report Fraud

Waste or Abuse

Official Site of The State of New Jersey

Official Site of The State of New Jersey