Good news! Record Levels of Savings & Expanded Health Coverage Access

are available through Get Covered New Jersey

Federal and State Savings

The federal government passed a COVID-19 relief bill, the American Rescue Plan Act of 2021, which was signed into law by President Biden on March 11, 2021. The law reduces health insurance premiums by providing more financial help to eligible consumers who purchase a plan through Get Covered New Jersey. The Inflation Reduction Act of 2022 continues these savings. The State of New Jersey is also providing more financial help to lower health insurance costs for residents enrolling at Get Covered New Jersey.

More people than ever now qualify for financial help. If you did not qualify for financial help before 2021 because your income was too high, you may qualify under the state and federal changes. These changes make coverage more affordable at many income levels.

The State of New Jersey remains focused on improving residents’ access to quality, affordable health insurance. The financial help available through the federal government and the State of New Jersey builds on the state’s efforts to provide access to health coverage for more New Jerseyans.

Here are more details on the federal and state savings:

- Increases in financial help for all eligible consumers. The amount of financial help is based on household income just like before, but in 2021 increased at every income level due to more financial help provided by both the state and federal government. The record levels of savings remain available due to passage of the Inflation Reduction Act.

- New financial help for higher incomes. Previously, financial help was not available for households making more than $51,040 for an individual or $104,800 for a family of four. The federal changes ensure that no family spends more than 8.5% of their income on health insurance premiums - at any income. This means many individuals who previously did not qualify for financial help from the federal government may see more affordable premiums. On top of the federal financial help, the State of New Jersey also increased financial help to higher incomes, to further lower premiums.

Expanded Health Coverage Access

As part of its goal to advance health equity, New Jersey introduced a new Special Enrollment Period (SEP), the Expanded Access Special Enrollment Period, in 2022 that allows consumers at a certain income level to enroll throughout the year in free or nearly free coverage. Consumers with an annual income up to 200% of the Federal Poverty Level ($27,180 for an individual or $55,500 for a family of four in 2023) can now qualify for a Special Enrollment Period to enroll any time of the year with access to plans with low or no monthly premium.

Consumers who qualify for this SEP will automatically be identified when they submit their application for coverage, and can begin shopping by clicking on the “Shop for Plans” button after submitting the application.

Questions? Visit our Frequently Asked Questions or contact our Call Center.

Use these step-by-step guides to see if you qualify now:

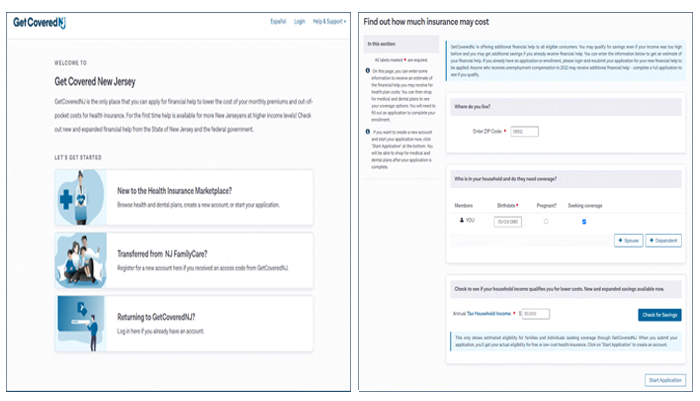

- New to GetCoveredNJ? Click here for the steps you should take.

- Already enrolled in GetCoveredNJ? Click here for the steps you should take.

Official Site of The State of New Jersey

Official Site of The State of New Jersey