What could 2% do for your municipality?

As New Jersey’s cannabis industry continues to expand, municipalities have the unique opportunity to shape how cannabis businesses operate within their communities – and how their towns can benefit from the resulting additional tax revenue. Under the Cannabis Regulatory, Enforcement Assistance, and Marketplace Modernization Act (CREAMMA), municipalities have the choice to “opt in” to allowing cannabis businesses in their jurisdiction and taxing those businesses up to 2% on sales. The legislation allows municipalities to tap into potential economic benefits while retaining control over how and which cannabis businesses operate in their communities.

Flexibility and Local Control

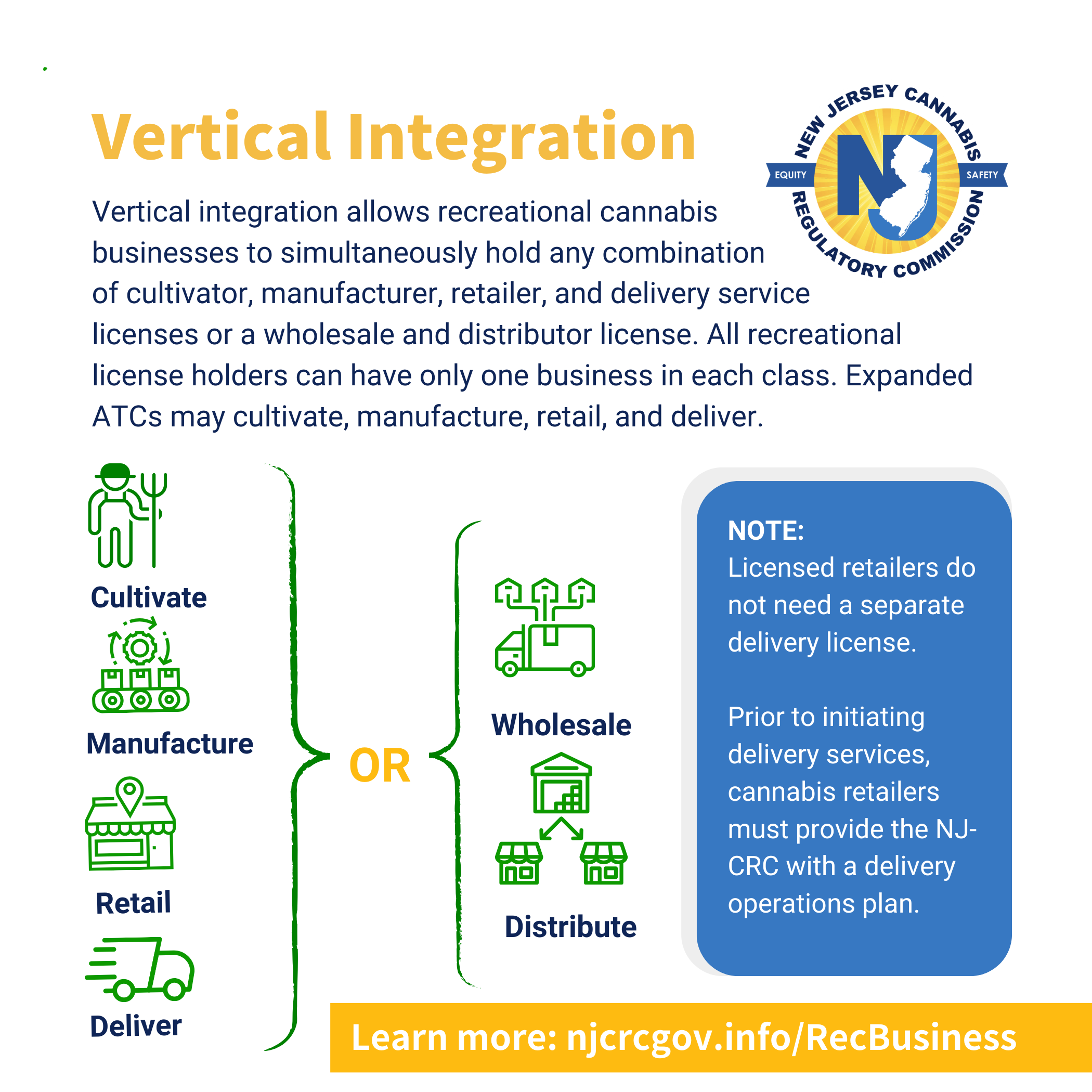

Local governments have the authority to determine how many and which of the classes of cannabis businesses they will allow, whether retailers, cultivators, manufacturers, wholesalers, or delivery services. They also can set limits on the number of licenses issued and establish zoning regulations that dictate where these businesses can operate. Furthermore, municipalities have the ability to regulate business hours, parking requirements, and even specific operational guidelines.

This flexibility allows municipalities to tailor their cannabis market to meet the needs of their individual communities. Whether a town wants to limit cannabis businesses to a certain area or encourage business development in underutilized zones, opting in provides the framework to make those decisions locally.

Economic Benefits

The financial incentives for municipalities to opt into cannabis businesses are significant. Local governments can impose a local cannabis sales tax on businesses that operate within their jurisdiction. Under the CREAMM Act, municipalities can levy a tax rate of up to 2% of the receipts from each sale by cultivators, manufacturers, and retailers, and 1% of the receipts from each sale by wholesalers.

These funds can boost municipal budget and inject valuable dollars into a municipality’s budget to help offset the costs of road repairs, park and rec improvements, youth and senior programs, or even sustainability initiatives. For example, in the first quarter of 2024, it was estimated that municipal tax revenue from cannabis businesses in New Jersey was expected to exceed $4 million. The industry is on track to earn more than a billion dollars by the end of 2024. With the flexibility to allocate these funds as they see fit, municipalities can make meaningful, long-term investments in their communities.

Promoting Public Safety

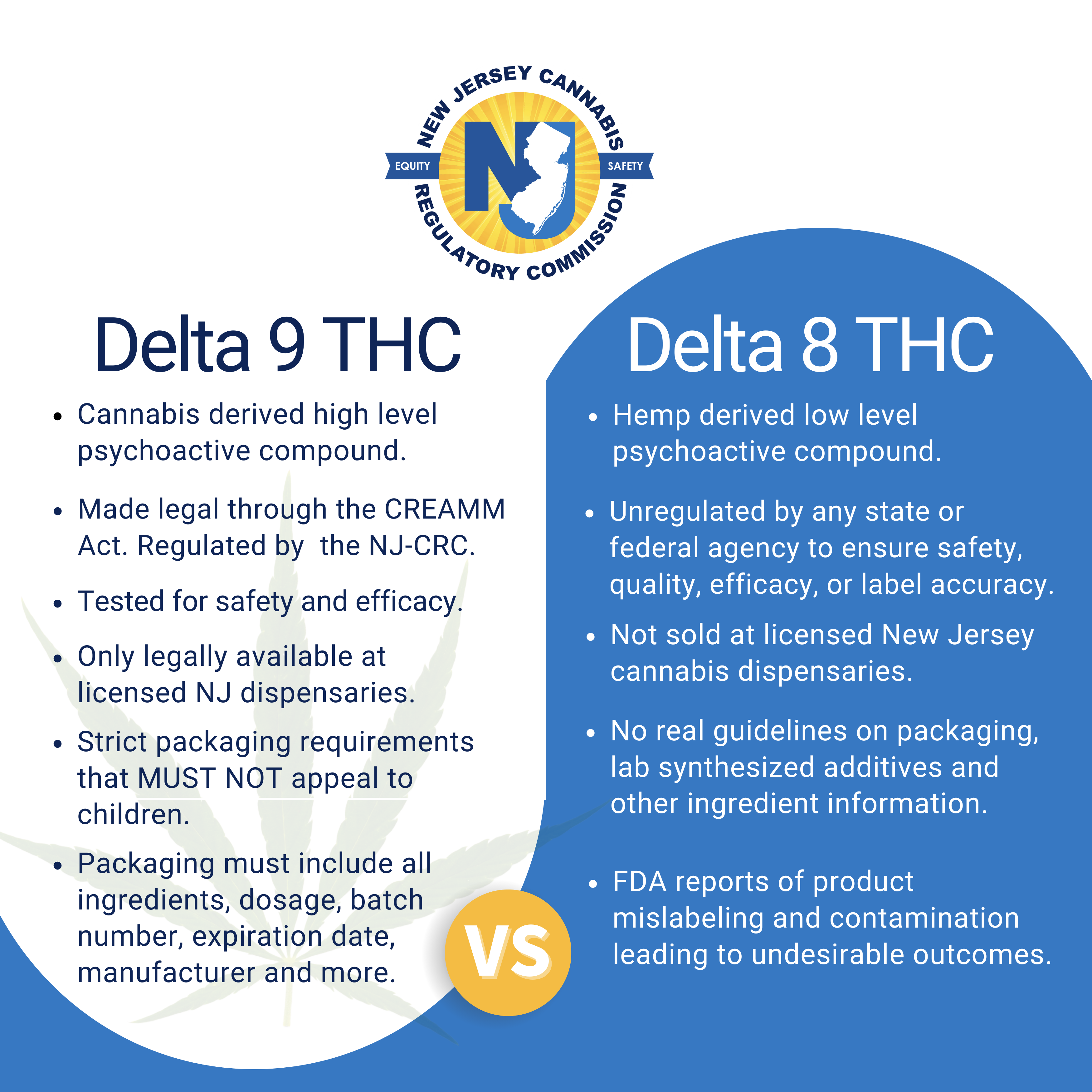

Opting into cannabis business licenses also enhances public safety. Regulated cannabis businesses in New Jersey must adhere to strict state guidelines that ensure all operations—from cultivation to retail sales—are safe, legal, and transparent. Licensed cannabis businesses are required to follow stringent safety protocols that include measures to prevent underage sales and to ensure product quality.

This is in stark contrast to illicit unregulated cannabis businesses that may flourish and operate outside of the state’s safety and legal guidelines – including strict underage deterrence. Illegal businesses do not follow state safety guidelines and can pose risks to public health and safety. By opting in, municipalities give adult residents legal options and help combat illegal markets, ensuring cannabis is sold and consumed responsibly within their borders.

Access to Resources

The New Jersey Cannabis Regulatory Commission (NJ-CRC) provides municipalities with resources to support safe cannabis use and responsible business operations. Resources include educational materials on preventing underage consumption, promoting safe driving, and ensuring the safe and responsible use of cannabis. Municipal leaders can download materials from our website toolkits, access FAQs, or request materials to share with residents.

Additionally, the NJ-CRC website features a Government Relations page dedicated to providing information for and related to municipal governments and their cannabis regulations. The page features a searchable chart of municipalities that opted into the cannabis adult cannabis market, filters municipalities by county, and breaks down the types of business classes each municipality permits in their jurisdictions. If a correction needs to be made, please email crc.muni@crc.nj.gov with your municipality and the information you would like to update.

Opting into cannabis business licenses offers municipalities in New Jersey a range of benefits, from increased revenue to enhanced public safety and local control. As the cannabis industry grows, municipalities that embrace this opportunity can help shape a responsible and thriving market that benefits businesses and residents.

Previous Blog Posts

High Hopes: Guiding budding businesses with the NJ-CRC

09/5/2025

Nana Amponsah, business development representative at NJ-CRC, talks about her role, as part of the Office of Diversity & Inclusion, in identifying challenges cannabis entrepreneurs face, providing assistance to applicants and new businesses wherever possible, and acting as a liaison between cannapreneurs and other state agencies that provide support. She also explains how NJ cannabis business development differs from other fields, emphasizing the continuous need for support.

Tips for SMART Gatherings This Holiday Season

11/26/2025

The holidays are a time for food, fun, laughter, and connecting with the people who make life sweeter. And as more adults in New Jersey choose to enjoy, or gift legal cannabis during the season, the NJ-CRC has launched its second safe-use campaign, S.M.A.R.T., to help keep celebrations (relatively) stress-free. S.M.A.R.T. is an easy way to remember the basics of responsible cannabis use, especially when travel is constant, roads are chaotic, homes are busy, and curious little ones are wandering.

Cannabis and PTSD

10/20/2025

Everyone feels pain at some point—whether it’s a sore back after a long day, a pounding headache, or stomach cramps that just won’t let up. But for some people, pain isn’t temporary. It’s a constant part of daily life. Anxiety disorders are the most common qualifying condition for New Jersey’s Medicinal Cannabis Program (MCP). However, various forms of pain also rank highly on the list of qualifying conditions. Specifically, chronic pain related to musculoskeletal disorders is the second most common condition, migraines are fourth, and chronic pain originating from visceral sources ranks fifth.

Official Site of The State of New Jersey

Official Site of The State of New Jersey