Department of the Treasury

Department of the Treasury

Treasury: April Major Revenues Up; Treasurer Releases Revised Forecasts

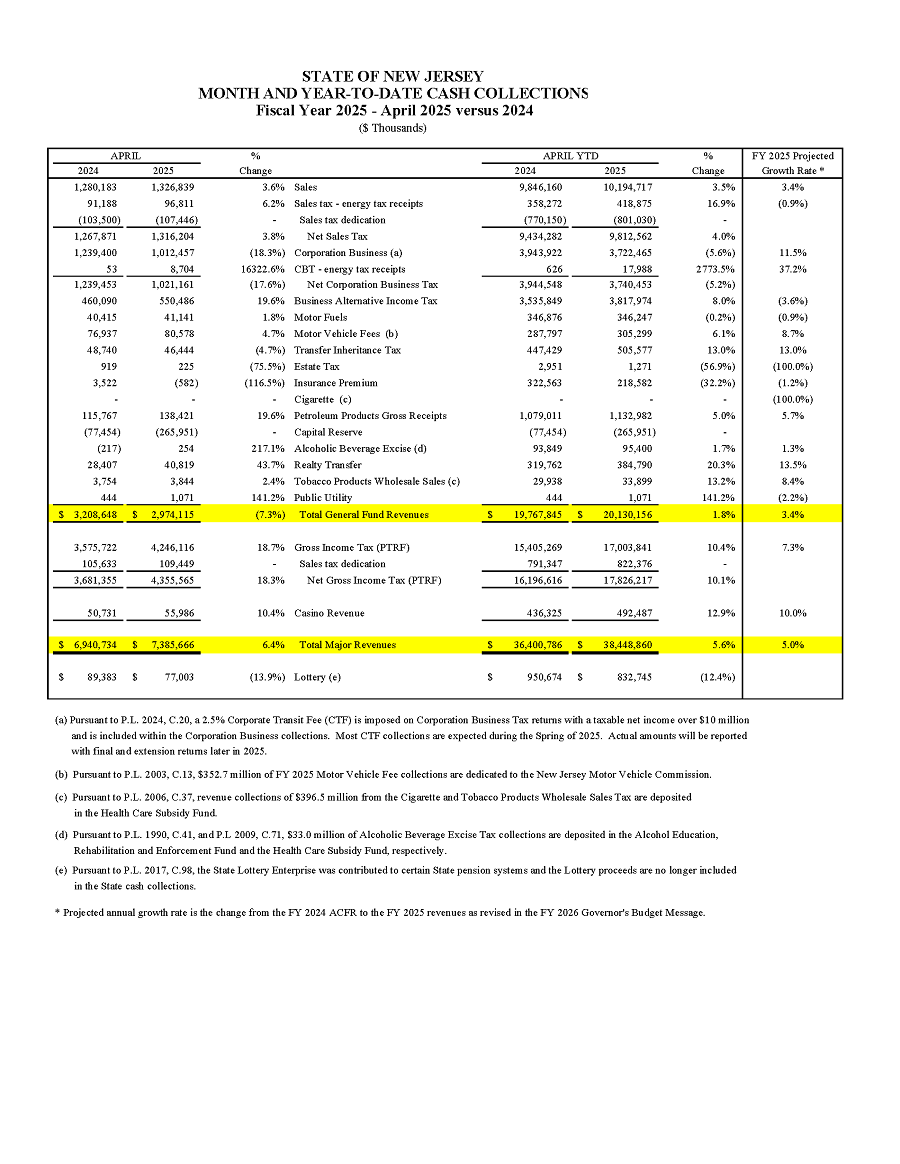

(TRENTON) – The Department of the Treasury reported today that April revenue collections for the major taxes totaled $7.386 billion, up $444.9 million, or 6.4 percent ahead of last April. Strong growth from the Gross Income Tax (GIT) offset a decline in the Corporation Business Tax (CBT). Fiscal year-to-date, total major revenues of $38.449 billion are now running higher by $2.048 billion, or 5.6 percent above the same period last year.

April collections for the GIT, which are dedicated to the Property Tax Relief Fund, totaled $4.246 billion, up $670.4 million, or 18.7 percent higher than last year, registering strong growth across most components. GIT revenues would have been up $464.1 million, or 12.3 percent above last year, after adjusting for an extra Wednesday withholding payment compared to last April. April is the most important month for final payments, which totaled $3.433 billion, up $602.2 million, or 21.3 percent above last April. Refunds also increased significantly for the month as refund processing continues to outpace 2024. Fiscal year-to-date, GIT revenue collections of $17.004 billion are higher by $1.599 billion, or 10.4 percent above this time last year.

The Sales and Use Tax (SUT), the State's largest General Fund revenue source, totaled $1.327 billion, an increase of $46.7 million, or 3.6 percent over last April. Due to a one-month lag in the reporting and payment of Sales Tax, April revenue reflects consumer activity in March. Fiscal year-to-date collections of $10.195 billion are now running $348.6 million higher, or 3.5 percent above last year. SUT collections growth has trended somewhat lower than the rate of regional core inflation for eleven of the past fifteen months.

The CBT, the second largest General Fund revenue source, totaled $1.012 billion in April, a decrease of $226.9 million, or 18.3 percent below last year. While the State due date for CBT final payments is not until May, April remains a key final payment month as companies continue to make payments and file returns according to the federal schedule. CBT final payments totaled $585.2 million in April, falling by $175.2 million, or 23.0 percent below last year. April also marks the first due date month for estimated payments for Tax Year 2025, which were down by $68.3 million, or 17.5 percent. A preliminary analysis of return data suggests that reduced CBT payments in Fiscal Year 2025 may be attributable to the increased use of net operating losses by corporate taxpayers. Fiscal year-to-date collections of $3.722 billion are down $221.5 million, or 5.6 percent lower compared to the same period last year.

Pass-Through Business Alternative Income Tax (PTBAIT) payments totaled $550.5 million in April, up $90.4 million, or 19.6 percent above the same month last year. April marks the first quarterly estimated payment due date for PTBAIT. Estimated payments totaled $518.3 million, higher by $77.8 million, or 17.7 percent compared with last April. Fiscal year-to-date revenues of $3.818 billion are now up $282.1 million, or 8.0 percent above last year.

With the overall revenue picture generally positive this year, Treasurer Elizabeth Maher Muoio appeared before the Legislature's budget committees this week to provide updated State revenue forecasts. The FY 2025 forecast improved by $388.5 million, about 0.7 percent above the prior expectation.