How to Complete an Employer Statement

Here are step-by-step instructions for filling out the Employer Statement for an employee’s Temporary Disability or Family Leave Insurance application.

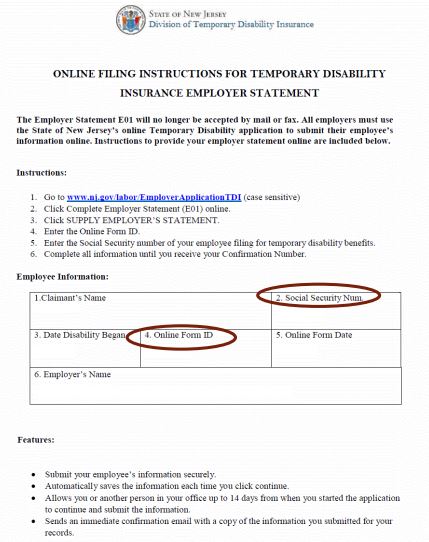

If your employees apply online for Temporary Disability Insurance Benefits, they will provide you with an instruction sheet that contains their unique Online Form ID number and Social Security number (see below). This sheet has all the information you’ll need to file your Employer Statement (E01) online. Verify that your business name appears in item #6.

Employees who don’t file online need to mail or fax us a completed paper Application for Temporary Disability Benefits (form DS-1). Employers then need to submit the Employer Statement (part C of the application) by mail or fax as well.

If we do not receive the Employer Statement online or via mail or fax, we will send you a wage report request (form E-20) that you must complete and submit within 10 days to avoid fines.

For more information about reporting employee wages, click here.

Click here to access the employer portal where you can enter the information we need. At the bottom of the screen, click on the link that says “Supply Employer’s Statement.”

On the next page, you’ll see two boxes to enter the patient’s Online Form ID and Social Security number (numerals only, no dashes). After entering this information, click the button that says “Log In.”

Note: If you make a mistake entering the Online Form ID number, you will get an error message. Please double check and reenter the number. After three incorrect attempts, you will be locked out of the system for that employee’s application, and now must download, print, and mail or fax your statement to us. You need to complete and submit only the Employer Statement (part C) of the application (form DS-1) to us. The employee submits the rest of the information separately.

After entering the Online Form ID number and Social Security number, you should see your employee’s name on the next screen. Confirm you have the correct employee before proceeding.

On the next screen, you’ll need to enter your Federal Employer Identification Number (EIN) and click the “Submit” button. (If you enter it incorrectly, you’ll get an error message – correct your entry and try again.) When your EIN has been accepted, you can confirm or update your business information before proceeding.

On this page and the remaining tabs of the application, enter all required information about your business and your employee in the boxes marked with a red star, and click “Continue.”

When you complete all the necessary information, you will be presented with a summary sheet. At this point, you have three options:

- Edit/Review: If any information is wrong, click the “Edit/Review” button to go back and correct it. Remember, your certification is not complete until you choose “Verify Now” and complete the certification process.

- Verify Later: If you are unable to submit the statement now, you can save your progress and return to it within 14 days for certification using the Online Form ID number and employee’s Social Security number.

- Verify Now: Choose this option to proceed to the certification step.

To submit your statement, enter your name and title as a representative of the business. Select that you want to certify the information you have provided by clicking the "Agree" button. (If you need to change any information, click "Disagree" and start over.) Then click "Submit Employer Information."

A summary of the information you submitted will be sent to your email address. You can also print out a summary from this page.

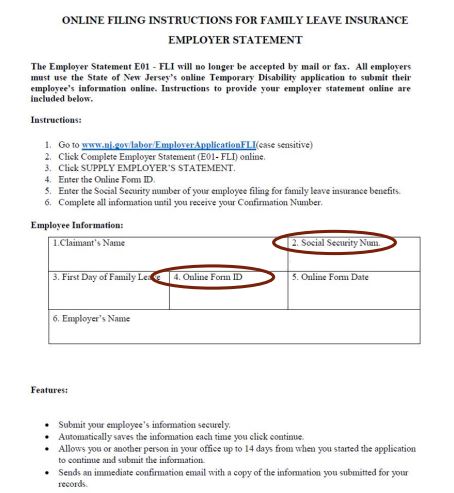

If your employes apply online for Family Leave Insurance benefits, they will provide you with an instruction sheet that contains their unique Online Form ID number and Social Security number (see below). This sheet has all the information you’ll need to file your Employer Statement (E01) online. Verify that your business name appears in item #6.

Employees who don’t file online need to mail or fax us a completed paper Application for Family Leave Insurance Benefits (form FL-1). Employers then need to submit the Employer Statement (part D of the application) by mail or fax as well.

If we do not receive the Employer Statement online or via mail or fax, we will send you a wage report request (form E-20) that you must complete and submit within 10 days to avoid fines.

For more information about reporting employee wages, click here.

Click here to access the employer portal where you can enter the information we need. At the bottom of the screen, click on the link that says “Supply Employer’s Statement.”

On the next page, you’ll see two boxes to enter the patient’s Online Form ID and Social Security number (numerals only, no dashes). After entering this information, click the button that says “Log In.”

Note: If you make a mistake entering the Online Form ID number, you will get an error message. Please double check and reenter the number. After three incorrect attempts, you will be locked out of the system for that employee’s application, and now must download, print, and mail or fax your statement to us. You need to complete and submit only the Employer Statement (part D) of the application (form FL-1) to us. The employee submits the rest of the information separately.

After entering the Online Form ID number and Social Security number, you should see your employee’s name on the next screen. Confirm you have the correct employee before proceeding.

On the next screen, you’ll need to enter your Employer Identification Number (EIN) and click the “Submit” button. (If you enter it incorrectly, you’ll get an error message – correct your entry and try again.) When your EIN has been accepted, you can confirm or update your business information before proceeding.

On this page and the remaining tabs of the application, enter all required information about your business and your employee in the boxes marked with a red star, and click “Continue.”

When you complete all the necessary information, you will be presented with a summary sheet. At this point, you have three options:

- Edit/Review: If any information is wrong, click the “Edit/Review” button to go back and correct it. Remember, your certification is not complete until you choose “Verify Now” and complete the certification process.

- Verify Later: If you are unable to submit the statement now, you can save your progress and return to it within 14 days for certification using the Online Form ID number and employee’s Social Security number.

- Verify Now: Choose this option to proceed to the certification step.

To submit your statement, enter your name and title as a representative of the business. Select that you want to certify the information you have provided by clicking the “Agree” button. (If you need to change any information, click “Disagree” and start over.) Then click “Submit Employer Information.”

A summary of the information you submitted will be sent to your email address. You can also print out a summary from this page.

Official Site of The State of New Jersey

Official Site of The State of New Jersey