Tipped Workers

New Jersey’s minimum wage law took effect on July 1, 2019, lifting the earnings of more than one million workers. In 2025, New Jersey’s minimum hourly wage for most employers is $15.49 (see the minimum wage chart in the tabs below).

This law also permits employers of tipped employees to take a “tip credit” toward their obligation to pay the minimum wage by paying a portion in cash to the employee with the balance of the minimum wage made up in earned tips. Tips are the sole property of the employee, and an employer may not take any portion of a worker's earned tips for any purpose.

- A tip is money given to an employee by a customer in recognition of a service performed for the customer.

- A tip is made in addition to the amount charged for the service performed, and the customer decides if, to whom, and how much to tip.

- A tip can be a cash sum given directly to the employee, or it can also be given by another transfer method, such as when a customer pays by credit card and adds an amount to their card for the tip.

- Tips belong to the employee, whether or not the employer has taken a tip credit.

No. If the employer’s establishment charges a compulsory service charge, such as 15 percent of the amount of the bill, this cannot be counted as tip under NJ law, even if the employer eventually distributes the charge to their employees.

For example:

- Where negotiations between a hotel and a customer for banquet facilities include amounts for distribution to employees of the hotel, the amounts distributed are not counted as tips.

- When a restaurant assesses an additional charge for parties over a certain number of people, this is not considered a tip under the law.

A tipped employee is any worker (full-time, part-time, or temporary) engaged in an occupation in which they customarily and regularly receive more than $30 per month in tips. An employee who customarily and regularly receives more than $30 in tips over a one-month period, but occasionally does not, is also considered a tipped employee. For example, if an employee does not receive tips because they were out sick or on vacation, or because business was slow in a given week, they are still considered a tipped employee.

Only tips kept by the employee count toward the $30 threshold for tipped employee status. If an employee receives tips, but a portion gets redistributed to another employee via a tip pool, then the amount redistributed is not included in the $30 per month count.

Not sure if you are a tipped employee? Email wage.hour@dol.nj.gov and a staff member will help you answer this question.

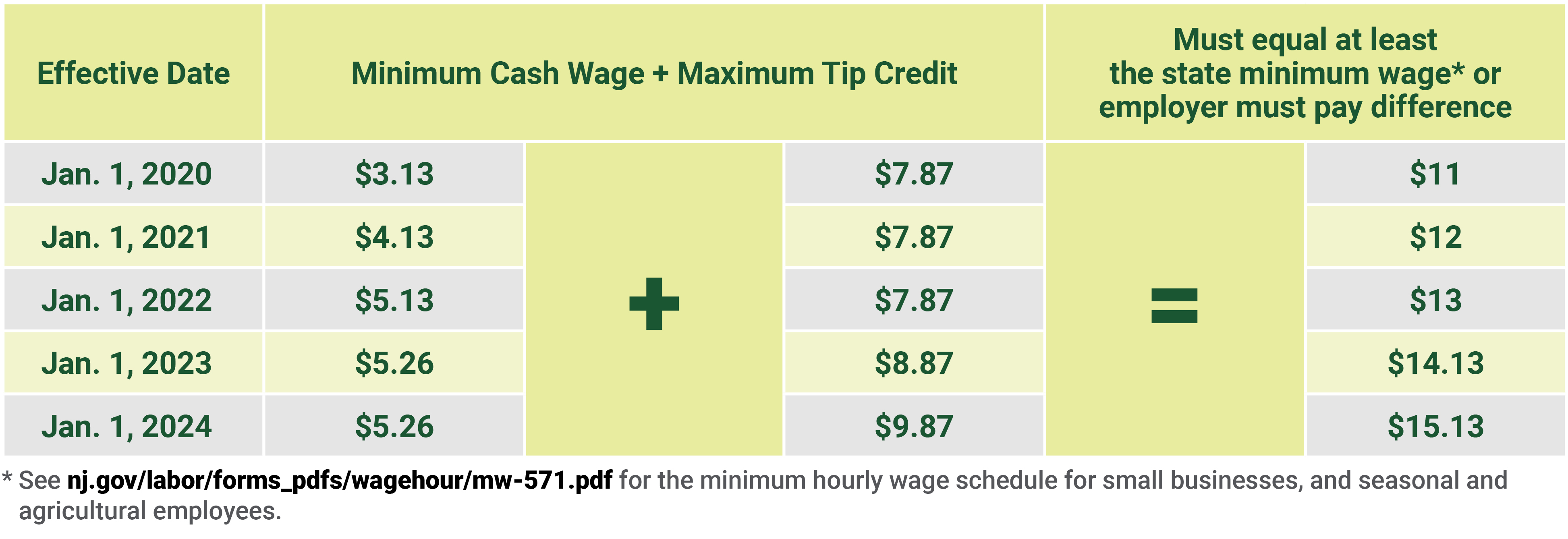

Under New Jersey law, an employer can apply up to a set maximum amount of an employee’s tips towards their minimum wage obligation. This is called taking a tip credit. The maximum tip credit allowed under the NJ law is scheduled to increase annually through 2025.

In order to apply the maximum tip credit amount under the law, the employer must show that the employee received at least that amount in actual tips.

Tip pooling occurs when tipped employees combine all or some of their tips and redistribute the sum among themselves at the end of a work shift or other determined timeframe.

An employer must notify its employees of any required tip pool contribution amount, may only take a tip credit for the amount of tips each employee ultimately receives, may not keep any of the employees’ tips for any other purpose, and may not distribute them to non-tipped employees.

Where the employer is taking a tip credit, once tips retrieved from the pool and cash wages from the employer are computed, an employee must receive the full state minimum hourly wage. If the hourly sum is less, the employer must make up the difference.

Effective January 1, 2025, employers applying a tip credit must pay tipped employees a minimum of $5.62 per hour. Click here to see a chart of New Jersey's minimum wage.

Total earnings (hourly cash wage plus tips) must equal at least the minimum wage.

If total earnings are less than the minimum hourly wage, then the employer must pay the employee the difference.

For example:

- Pam is a server at a restaurant. In one work week, she worked 40 hours and earned $500 in tips, or $12.50 an hour in tips. Her employer applied the maximum tip credit of $9.87 per hour against the full state minimum hourly wage of $15.49, and paid her a cash wage of $5.62. During this work week, Pam received $18.12 an hour, which is above the minimum wage of $15.49 an hour. So, this use by the employer of the maximum tip credit is lawful.

- In the next work week, with most customers now ordering takeout, Pam’s tips are down. During this work week, she worked 40 hours and made $200 in tips, or $5 an hour. Now an hourly cash wage of $5.62 plus $5 an hour in tips equals $10.62, which is below the full state minimum hourly wage. Pam’s employer must pay her the difference of $4.87 ($15.49 - $10.62) to ensure she receives at least the State minimum hourly wage of $15.49 per hour.

Under New Jersey Wage and Hour Law, an employer is eligible to apply a tip credit against the full state minimum hourly wage only if the employer has informed its tipped employees in advance of the following:

- The amount of the cash wage that is to be paid to the tipped employee;

- The amount of the tip credit, which will be claimed by the employer, which may not exceed the value of the tips actually received by the employee;

- That all tips received by the tipped employee must be retained by the employee, except in case of a valid tip pool arrangement limited to tipped employees; and

- That the tip credit shall not apply to any employee who has not been informed of the requirements of J.A.C. 12:56-3.5.

Keep track of the hours you worked, pay, and employer’s contact information.

You can make a complaint online or call 609-292-2305.

Have questions? Email wage.hour@dol.nj.gov.

A trusted person can help file a complaint or email us on your behalf. NJDOL also has multilingual staff who can help.

NJDOL can issue penalties and fines against employers that do not comply with the law.

Worried your employer might take action against you for using or asking about your workplace rights? Our laws protect you from retaliation by a current or former employer.

Your identity and other personally identifiable information are protected from disclosure to your employer and others, with limited exceptions. For more information, click here.

A tipped employee may spend some time performing non-tipped duties related to their tipped work. However, in NJ, when a tipped employee spends more than 20 percent of their time performing related non-tipped duties, the employer is prohibited from taking a tip credit for the time spent performing the related non-tipped duties. That is, for the time spent performing the related non-tipped duties, the employer must pay the full state minimum hourly wage. This is referred to as the 80/20 rule.

For example:

- Santiago spends 30 hours styling hair and 10 hours preparing hair coloring mixtures and folding towels. His employer can apply a tip credit against the full state minimum hourly wage for the 30 hours of hair styling, but not for the 10 hours spent on related non-tipped duties, as those 10 hours of non-tipped work account for 25 percent of Santiago’s work time.

- Desiree works as a waitress 30 hours per week. She spends 5 hours a week folding napkins and setting tables. Her employer could take a tip credit against each of the 30 hours as the five hours of non-tipped work equal only 17 percent of her total work hours.

- For the job for which the employee customarily and regularly receives at least $30 per month in tips (and, therefore, is considered a tipped employee), the employer may take a tip credit for hours worked in that job.

- For the job for which the employee does not customarily and regularly receive at least $30 per month in tips (and, therefore, is not considered a tipped employee), the employer may not take a tip credit.

For example:

Trinh works as an accountant for a nail salon, 20 hours a week. She also works there as a nail stylist for another 20 hours a week, and customarily and regularly receives more than $30 per month in tips in that job. Her employer can only take a tip credit for the 20 hours she works as a nail stylist. For the remaining 20 hours a week of accounting work, the employer must pay Trinh the appropriate state minimum hourly wage.

No, an employer is prohibited from using an employee’s tips, whether or not they have taken a tip credit, for any reason other than as wages or in furtherance of a valid tip pool. This includes a prohibition against the employer using an employee’s tips to pay any portion, however small, of the fee charged to the employer by a credit card company or other financial institution for the use of credit or debit cards in their businesses, including the processing of such credit or debit card transactions.

It depends. New Jersey’s Wage Payment Law contains a list of permissible wage deductions. For example, it is permissible for an employer to make deductions from wages for payments authorized by the employee or their collective bargaining agent for rental of work clothing or for the laundering or dry cleaning of work clothing. However, deductions from wages other than those listed in the Wage Payment Law, such as for breakage or cash register shortages, are unlawful.

Overtime pay must be 1.5 times an employee’s hourly rate of pay for any hours worked over 40 hours per week. When an employer takes a tip credit, overtime is calculated on the full minimum hourly wage, not the lower cash wage payment. The employer cannot take a larger tip credit for an overtime hour than for a straight time hour – i.e., no more than $9.87 in 2025.

For example:

- A tipped employee who works 44 hours in a week must be paid $23.24 an hour for the 4 overtime hours, or $92.94 ($15.49 x 1.5 x 4 = $92.94).

Under the NJ Earned Sick Leave Law, almost all employees in New Jersey are entitled to up to 40 hours of paid leave to care for themselves or a loved one.

- When a tipped employee uses earned sick leave, the employer must pay them at their normal rate of pay. The employer is required to calculate the rate of pay for earned sick leave by adding together the employee’s total earnings, including tips (but excluding overtime premium pay), for the seven most recent workdays when the employee did not take leave and dividing the sum by the number of hours the employee spend performing the work.

- Where it is not feasible to determine the employee’s exact hourly wage for earned sick leave, the employer is to pay earned sick leave at the agreed upon hourly wage, but no less than the appropriate state minimum hourly wage.

- An employer may not take a tip credit during an employee’s sick leave.

- Learn more at mysickdays.nj.gov and review your leave benefit eligibility at getstarted.nj.gov/labor.

- Paid Sick Leave: up to 40 hours of Earned Sick Leave under NJ law (employer can decide to provide 40 hours up front or worker accrues at 1 hour per 30 hours worked).

- Unemployment Insurance: if you lose your job or work hours through no fault of your own; you must have earned a certain amount and be authorized to work in the U.S. Learn more at myunemployment.nj.gov.

- NJ Family Leave Insurance & Temporary Disability Insurance: if you cannot work because you must care for your own or a loved one’s illness or injury, bond with a new child, or recover from pregnancy/childbirth. You must have earned a certain amount to be eligible, and the application requires a valid social security number. Learn more about these programs at myleavebenefits.nj.gov.

- Job-protected family leave: to care for a child due to a public health emergency school or daycare closure during a state of emergency; care for a family member, or someone who is the equivalent of a family member, with a serious health condition or who has been isolated or quarantined because of suspected exposure to a communicable disease; or care for or bond with a child, as long as the leave begins within 1 year of the child’s birth or placement for adoption or foster care. Learn more at myleavebenefits.nj.gov/jobprotection.

How to get help or make a complaint:

If you believe that your employer has not properly paid you, or you have a question about your situation, we can help.

Make a complaint online, email wage.hour@dol.nj.gov, or call 609-292-2305. A trusted person can help file a complaint or email us on your behalf. NJDOL has multilingual staff who can help.

Your identity and other personally identifiable information are protected from disclosure to your employer and others, with limited exceptions. For more information, click here.

Other resources and information:

Official Site of The State of New Jersey

Official Site of The State of New Jersey