Division of Taxation

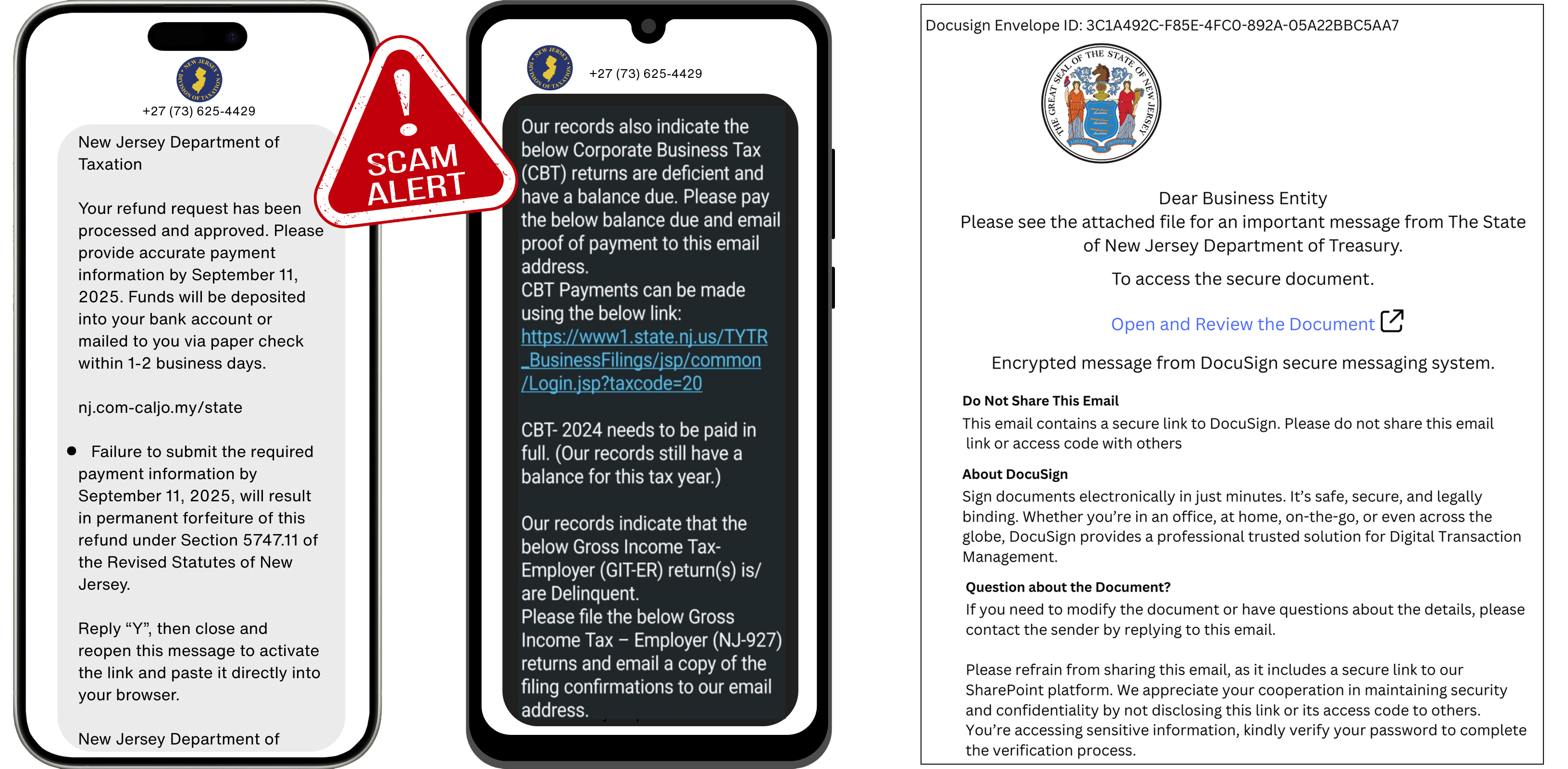

Division of TaxationWe have received reports of a scam targeting taxpayers through text messages and emails that appear to be from the Division. The New Jersey Division of Taxation will never initiate a text exchange or email to request personally identifiable information regarding individual income tax, business tax, or property tax relief benefits. If you get a text message or email claiming to be from the New Jersey Division of Taxation asking you to verify banking information, or provides a link to check your refund or to make a tax payment, it is a scam. These text messages and emails contain a link to a fraudulent version of certain Division web pages, which are designed to steal personal and banking information. Do NOT click the link or share personal information. If you are unsure about a message, contact us directly through our official channels.

Another recent phishing scam is targeting taxpayers via email, falsely impersonating The Department of the Treasury and multiple other New Jersey State agencies and organizations by abusing the legitimate Docusign platform. Please read more about the Docusign scam to ensure you do not fall victim to these scammers.

Residents who believe they may be a victim of a phishing scam should report it to the federal Internet Crime Complaint Center.

Scam Examples:

Do not be fooled by phone scammers pretending to be tax collectors demanding payment on behalf of the State of New Jersey or Division of Taxation. We rely primarily on the U.S. mail to make the first contact with individuals about their unpaid taxes.

In most cases, the tax collection process will escalate only if you do not respond appropriately to mailed notices. Our first notice of taxes owed will not demand immediate payment (especially using prepaid debit cards or cryptocurrency) or threaten you with police action.

If you have not received an initial notice in the mail, and someone calls or emails you stating you owe New Jersey taxes, there is a good chance that a scammer has targeted you. Any communication demanding payment with a pre-paid debit card or a gift card is a red flag.

You can report suspicious communications to the Federal Trade Commission.

You can confirm the Division is trying to contact you by calling the main Customer Service Center phone number.

The Internal Revenue Service (IRS) continually monitors potentially fraudulent activity and gathers information regarding new scams. This includes an annual list named "The Dirty Dozen" which represents the worst scam offenders.

You can find out more information on current scams affecting individuals, businesses, and tax professionals by visiting the IRS' website.

Phone scams can involve a caller who claims to be a New Jersey tax official.

Callers can falsify information to your caller ID, called cloning or spoofing, to hide their identity and trick you into giving away personal information. We will never call you from our Customer Service Center number 609-292-6400. An incoming call from this number is most definitely a scam attempt.

If you do get a call from a collection agency about New Jersey taxes, you can call our contracted agency, Pioneer Credit Recovery, at 1-866-372-6840 to confirm that the call was legitimate.

There are times when a Division employee will contact a taxpayer regarding tax payment via telephone. However, before the call we will send written notification, which can be verified by an agent in our Customer Service Center at 609-292-6400.

Perpetrators also have been known to impersonate police officers who demand payment to satisfy a debt. If you are not sure the person on the other end of the line is a Division of Taxation employee or a collection agency representative, hang up.

Smishing is a type of phishing scam that uses fraudulent text messages to trick you into revealing personal or financial information, often by clicking malicious links, providing sensitive data, or making payments.

Smishing texts may claim to be from the Division and sound urgent in nature. The text may ask you to verify banking information or make a tax payment by using a link they provide. They also may ask you to text back to confirm sensitive data like passwords, credit card numbers, bank account numbers, or Social Security numbers.

Take these steps to protect your personal information:

Phishing occurs when you receive an email asking for personal and sensitive information. Examples of sensitive information include: Social Security number, user name, password, credit card or bank account information.

Phishing emails may use the Division's logo and phone numbers. An email may direct you to a fake website that looks like ours and asks you to enter your personal information. Once your information is entered, it can be used to steal your identity.

Take these steps to protect your personal information:

We urge taxpayers with past-due tax debts to be on the alert for scam letters making the rounds through the U.S. Postal Service.

In this scam, taxpayers receive a letter about an overdue New Jersey tax debt that demands the taxpayer call a toll-free number to resolve the outstanding balance. The letter aggressively threatens to seize property – including bank accounts, wages, business assets, cars, real estate, refunds, and cash – if the debt is not paid.

The correspondence may appear credible because it uses personal facts and information pulled directly from the internet and public records. The scammer’s letter tries to scare you into revealing personal financial information or paying a phony tax debt.

If you receive a letter that claims to be from the Division of Taxation requesting personal and sensitive information, or an unexpected check , it may not be legitimate. View our list of mailing addresses to determine if the notice you received is legitimate. Contact us if it seems suspicious.