NJ Workers: Frequently Asked Questions During the COVID-19 Pandemic

Below are common questions about the programs and benefits available to NJ workers, with answers and links to additional information.

These laws and programs can be confusing. Please read carefully the information below and the additional resources linked from this page. It is important to apply for the program that best fits your situation – applying for the wrong one could cause delays.

Federal extended unemployment benefits expired on September 4, 2021. Please note that you will still be able to receive benefits for weeks prior to September 4, if you are found eligible for a claim filed before September 4, 2021. Learn more about state extended unemployment benefits here.

This information is current as of March 21, 2022. It will be updated as new information becomes available.

Those who meet the requirements for traditional unemployment insurance may receive benefits for up to 26 weeks during a one-year period.

Additionally, on July 1, 2020 New Jersey’s high unemployment rate triggered extended benefits for NJ workers who have exhausted unemployment benefits, if they meet, among other requirements, the minimum earnings requirement and the date of their initial UI claim is May 12, 2019 or later. Per federal regulations, on April 17, 2021, NJ state extended unemployment benefits were reduced from up to 20 weeks to up to 13 weeks because New Jersey’s unemployment rate went down. The state’s unemployment rates are reviewed monthly to determine if state extended unemployment benefits remain in place. While state extended unemployment benefits remain in place, claimants that have not collected state extended benefits yet and are eligible for them will transition to state extended unemployment benefits once federal extended benefits end on September 4, 2021. If you are on state extended unemployment benefits, your claim status will say “Extended Unemployment Benefits.”

Federal legislation expanded unemployment eligibility and extended unemployment benefits. These federal benefits expired on September 4, 2021. Visit our webpage on state extended benefits to learn more.

You are likely eligible for unemployment insurance. Learn more and apply online at myunemployment.nj.gov

You are likely eligible for unemployment insurance. Learn more and apply online at myunemployment.nj.gov.

You are likely eligible for unemployment insurance. Learn more and apply online at myunemployment.nj.gov.

While in most cases a claimant cannot refuse “suitable work” and collect benefits, where the work poses a high degree of risk to health and safety to the claimant, they can refuse to accept the “unsuitable work” and continue to collect benefits. These determinations are highly fact-specific and are determined on a case-by-case basis. If the employee is found to be ineligible for unemployment benefits, they must return any benefits received after receiving the offer of suitable work.

Agricultural employers are urged to review this joint guidance. (Please watch for updates regarding the 2021 season.)

You are likely eligible. Eligibility decisions are made on a case-by-case basis. Learn more and apply online at myunemployment.nj.gov.

Yes. Click here for more information about applying for Unemployment Insurance after receiving Temporary Disability or Family Leave Insurance benefits.

Those who meet the requirements for traditional unemployment insurance may receive benefits for up to 26 weeks during a one-year period.

Federally extended unemployment benefits, which expanded unemployment benefits to cover a variety of COVID-19 scenarios, expired on September 4, 2021. If you have a new unemployment claim, and are not eligible for regular unemployment benefits, there are no additional unemployment benefits for you at this time.

Please note that you will still be able to receive benefits for weeks prior to September 4, 2021, if you are found eligible, for claims you filed before September 4, 2021. Learn more about extended unemployment benefits here.

To learn more about benefit extensions, visit here.

To receive benefits, you have to meet a minimum earnings requirement during your “base period.” The base period is the timeframe used to determine if you qualify for UI benefits and to calculate your benefit amount.

To be eligible for Unemployment Insurance benefits in 2021, you must have earned at least $220 per week during 20 or more weeks in covered employment during the base year period, or you must have earned at least $11,000 in total covered employment during the base year period.

To be eligible in 2022, you must have earned at least $240 per week during 20 or more weeks in covered employment during the base year period, or you must have earned at least $12,000 in total covered employment during the base year period.

Learn about unemployment benefit eligibility here.

Federal law requires a review of unemployment claims after one year for benefits to continue. It’s not a glitch, so do not open a new claim.

New Jersey claimants currently receiving benefits do not have to take any action. Attempting to file a new claim after receiving your last week of benefits on your old claim will delay benefits.

Learn more here.

NJ’s Unemployment Insurance system experienced record levels of demand due to coronavirus and all in-person services statewide are currently closed due to COVID-19. We understand your anxiety and frustration, and we apologize. We’re working diligently to serve all our customers and ask for your patience. Please keep trying. We’re committed to ensuring that everyone receives the benefits for which they are eligible. If you believe your claim should be backdated, you’ll need to request a backdate over the phone, even if you submit your application online.

- Applying online at myunemployment.nj.gov is fastest and we recommend filing in the evening or early in the morning.

- If there are glitches in our online systems, keep trying.

- iPhone/Mac Users – Please use Chrome, Firefox or Edge browsers to complete this process. Users have experienced challenges uploading any required documents through the Safari browser.

- Please note that it’s not possible to save your online application and return to it. You must complete it and submit it all at once.

- Once you’ve submitted your application, you will receive a confirmation number at the end of your application. Write it down. You will receive email instructions on how and when to claim benefits. If you don’t receive an email, you must phone the call center (see numbers below).

All claims have a start date of the Sunday of the week in which the worker files the unemployment application, so there is no rush to file on the day you cannot work. As long as you file by Saturday at midnight, you will receive credit back to the previous Sunday. If your last day of work is a Friday or Saturday, and you worked the full week, please wait to file until after Sunday. Otherwise, you may inadvertently file for a week when you actually worked.

If you need specific questions answered before you apply, please first review these FAQs and the webpages listed. You can try to reach our Unemployment program on the phone.

We’re experiencing record high call volume, but we’re working diligently to serve all our customers and ask for your patience.

- North Jersey: 201-601-4100

- Central Jersey: 732-761-2020

- Southern Jersey: 856-507-2340

Many people have questions about the procedure for telling the State that you remain under- or unemployed, also known as “certifying for weekly benefits.”

Read our article about certifying for benefits.

Unemployment benefits provide 60% of average weekly wages within the claim’s base year, with a maximum of $804 per week in 2022. Learn more here.

The time to process a claim depends on many factors, including - but not limited to - number of employers, benefits history, and employment history.

Please note the following:

(1) be sure you file for the right benefit program (see our page about information on employer-provided paid leave and other state benefits);

(2) filing online is the fastest;

(3) provide all required information, including your NJ driver license number, if you have one;

(4) the system is experiencing record-high levels of demand.

We understand that this is an extremely challenging time for many New Jerseyans. We are working as quickly as we can to process claims. If you believe your claim should be backdated, please contact our call center to request a future interview to determine if your claim can be backdated. Visit myunemployment.nj.gov/morehelp to locate services that can help you and your family at this time.

You apply in New Jersey at myunemployment.nj.gov.

If you work in multiple states, you can file in any of the states where you work. Eligibility varies by state.

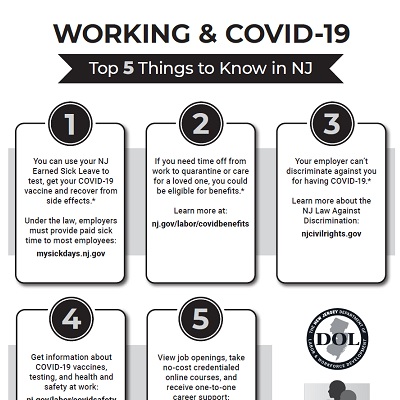

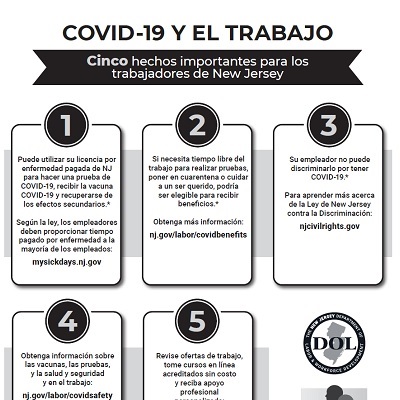

Yes, employees can use their NJ Earned Sick Leave to get their COVID-19 vaccine, including for travel to and from their appointment and recovery from side effects. Under NJ state law, employers must provide up to 40 hours of paid earned sick leave per year to most full- and part-time employees, including migrant and seasonal employees. To learn more or file a complaint see mysickdays.nj.gov.

For most New Jersey workers, yes. The federal government is exempt. Temporary Disability is optional for local government, for example counties, municipalities, and school districts.

Once your healthcare provider determines your pregnancy prevents you from working (typically 4 weeks prior to your due date), you must stop claiming weekly Unemployment benefits. You do not need to notify the Division of Unemployment Insurance that you are no longer collecting benefits from them. Once you stop certifying for Unemployment, apply for Temporary Disability Insurance benefits for the period during pregnancy and delivery recovery. Once your Temporary Disability period ends, you can transition to NJ Family Leave Insurance to bond with your baby.

Refusing an offer of suitable work would disqualify you from regular UI benefits. Federal Pandemic Unemployment Assistance, which expired September 4, 2021, was available to those unable or unavailable to work due to a COVID-19 related reason, including: (1) you are the primary caregiver for care for a child whose school or place of care is closed due to COVID-19; (2) you need to care for a family or household member who has been diagnosed with COVID-19; or (3) you are sick, quarantined or exposed to coronavirus. However, these are not qualifying reasons to receive regular unemployment benefits.

If your employer is covered under the New Jersey Family Leave Act (NJFLA) and you are an eligible employee, then you are generally entitled to up to 12 weeks of job-protected, unpaid leave to care for a loved one in a two-year period. This includes leave to care for a seriously ill loved one, or for your child if their school or place of care is closed by order of a public official due to COVID-19 or another public health emergency during a state of emergency. Employers that are state or local government agencies, or companies or organizations with 30 or more employees worldwide, are covered under this law.

To be eligible for the job-protected leave, you must have been employed by the agency or company for at least one year and have worked at least 1,000 hours in the past 12 months. If you were on furlough or laid off due to the COVID-19 state of emergency, any time, up to a maximum of 90 calendar days, during the COVID-19 furlough or time of unemployment can be counted as time in which you were employed.

To calculate the “hours worked” per week during the COVID-19 furlough or unemployment, use the average number of hours you worked per week during the rest of the 12-month period. This leave can be taken on a consecutive, intermittent, or reduced leave basis.

To receive the NJFLA leave, you should inform your employer that you are accepting the offer to return to work and of your emergent need to take leave to care for your child whose school/place of care is closed due to COVID-19 (a covered reason under the NJFLA). NJDOL does not enforce the NJFLA; it is enforced by the Division on Civil Rights, within the Department of Law and Public Safety. Learn more here and here.

If you return to work you have the right to up to 40 hours of NJ Earned Sick Leave to care for yourself or your loved one, or your child due to a COVID-19 school/care closure; you accrue 1 hour of earned sick leave for every 30 hours you work or the leave may be provided to you in a lump sum. Learn more here.

Learn more about paid leave and job protection for parents and guardians here.

In general, you will receive the same weekly benefit amount as you were receiving on your Unemployment Insurance claim. Click here for more information on how benefits are calculated.

Temporary Disability Insurance provides up to 26 weeks of benefits while you are unable to work. Your healthcare provider will determine the date that your medical condition prevents you from working and the duration of leave you will need. Most physicians recommend an expectant mother stop working 4 weeks before her scheduled due date, and that she recover for 6-8 weeks after childbirth. If your healthcare provider recommends quarantine outside of the above time frame due to your pregnancy and the risk of coronavirus you may be payable for a longer period of time. Your health care provider must provide the pre-existing diagnosis (pregnancy) and the duration you are expected to be out of work. For more information on benefits during pregnancy and newborn bonding click here.

Currently, workers can receive a total of 12 weeks of family leave benefits per year regardless of the reason for leave. For example, if you used 3 weeks of family leave benefits to care for a loved one who had COVID-19, you will have 9 weeks left to bond with your newborn under FLI. In addition to family leave benefits, a worker can also use NJ Earned Sick Leave. New Jersey workers have the right to accrue up to 40 hours of earned sick time. For more information on NJ Earned Sick Leave, click here.

Yes. Apply online at myunemployment.nj.gov. Click here for more information on Unemployment Insurance after Temporary Disability.

Apply online at myunemployment.nj.gov. However, if your Family Leave claim was started during a period of unemployment, you will have to call Unemployment Insurance and explain your situation. They will ensure that your Family Leave claim is ended and your UI claim is activated. The Unemployment Insurance program is experiencing record high call volume but we’re working diligently to serve all our customers and ask for your patience.

- North Jersey: 201-601-4100

- Central Jersey: 732-761-2020

- Southern Jersey: 856-507-2340

You may be eligible for NJ Family Leave During Unemployment. Learn more at myleavebenefits.nj.gov/unemployed.

Yes. You may be eligible for Temporary Disability Insurance, which provides up to 26 weeks of benefits while you are unable to work. Your healthcare provider will determine the date that your medical condition prevents you from working and the duration of leave you will need. Additionally, New Jersey workers have the right to accrue up to 40 hours of earned sick time. For more information on NJ Earned Sick Leave, click here.

Yes, you may be eligible for Workers' Compensation, which provides benefits to employees who suffer job-related injuries or illnesses. Speak to a Workers' Compensation attorney about your situation.

It is against the law for an employer to retaliate against you for using or seeking to use your Temporary Disability or Family Leave Insurance benefits. In addition, many NJ workers also have job protection for medical leave under another law, the federal Family and Medical Leave Act, and for family leave under the NJ Family Leave Act. Your NJ Paid Family & Medical Leave period may overlap with your coverage under these laws. It’s also possible that you are eligible for NJ Paid Family & Medical Leave benefits, but not covered under the job protection laws.

Your employer can’t discriminate against you for having COVID-19. Learn more about the NJ Law Against Discrimination: njcivilrights.gov

As a general matter, employers can set the terms of PTO usage unless there is an employee handbook, union contract, or prior agreement that says otherwise. In the absence of any of those, the company can require it to be used. The NJ Department of Labor enforces Breach of Contract but the contract must be in writing. An employer may not require you use your PTO before accessing NJ Family Leave Insurance and NJ Earned Sick Leave.

If you exhausted your unemployment benefits or are not eligible, or you need additional support, learn what additional resources may be available to you at: myunemployment.nj.gov/morehelp.

The Supplemental Nutrition Assistance Program (SNAP) can provide you with monthly food assistance to buy groceries and helps almost 800,000 NJ residents. While your weekly unemployment benefits do count as income for SNAP eligibility, the additional weekly $300 payments, called Federal Pandemic Unemployment Compensation (FPUC), no longer count. This favorable change to a federal rule regarding food assistance eligibility for individuals receiving unemployment benefits means more families now qualify for SNAP.

- If you applied for SNAP in the past, but were deemed ineligible because of FPUC income, you may now be eligible.

- This new federal rule can only be applied to SNAP applications completed on and after December 28, 2020.

- The fastest way to apply to SNAP is to submit a new application online or over the phone by calling your local board of social services.

If eligible, SNAP benefits are sent directly to an easy-to-use “Families First” electronic benefits card.

To learn more about SNAP visit www.njsnap.gov. To screen for eligibility, visit www.njhelps.org. Additional resources are available at myunemployment.nj.gov/morehelp.

IMPORTANT: When using the SNAP screening tool, in question 8, your regular weekly unemployment benefit counts as income. Do not include the $300 weekly FPUC benefits as a part of your income.

Please see this webpage to learn about mandatory remote learning and worker benefits and protections.

Additionally, if you need assistance finding child care, visit the NJ Child Care Resource and Referral Agencies page, administered by the NJ Department of Human Services (DHS). You can also apply for the state’s Child Care Subsidy Program if you need assistance paying for child care, also administered by NJDHS.

For information on additional resources and support, click here.

Download the flyer, or visit the NJ Department of Community Affairs for more information.

Official Site of The State of New Jersey

Official Site of The State of New Jersey